Consumers around the world are more fully engaged with supportive brands and businesses that incorporate sustainable practices into their product manufacturing, distribution and business operations – new research from supply chain transformation and omnichannel commerce fulfillment firm blue there confirms that nearly half (48 per cent) of those surveyed have grown in interest in sustainability over the past year, and most are keen to shop green where possible, even if it means buying some products have to pay more for

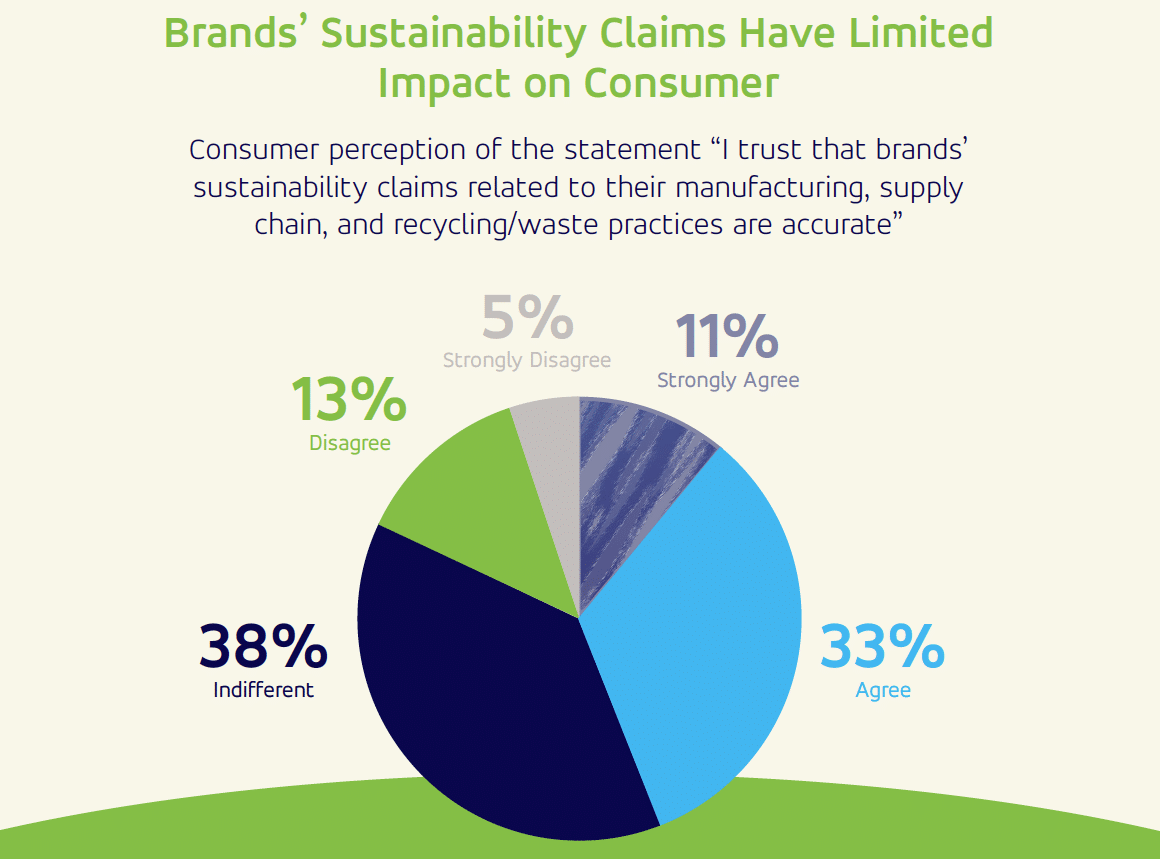

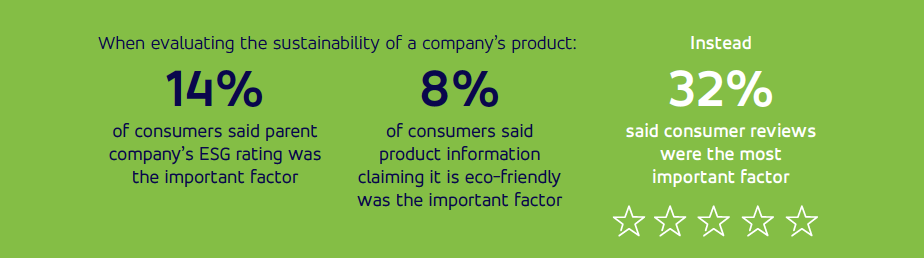

In general, consumers who were surveyed expressed ambivalence toward corporate environmental messaging – more than half (56 percent) were indifferent or not sure whether it relates to their manufacturing, supply chain, or recycling/waste practices. whether or not the brands’ claims of sustainability can be trusted, the firm’s 2023 Consumer Sustainability Survey finds. Rather than taking companies at their word, consumers are more interested in hearing from their peers – a third (32 percent) said consumer reviews hold the most weight in their green buying decisions.

But reviews are not that important in all age groups. Conservative shoppers (ages 60+) base product sustainability mostly on the use of recycled materials. Even with more official designations like ESG ratings, consumers aren’t sold—only 14 percent said ESG scores were the most important determinant, and 50 percent were completely unfamiliar with ESG scores.

“We are pleased to see that consumers are focused on adopting eco-conscious behavior with nearly three-quarters (74 percent) reporting purchases at retailers with sustainable products in the past six months.” Ed Wong, senior vice president, global retail leader at Blue Yonder, in a news release. “It is clear that successful, eco-friendly shopping must be driven by a symbiosis between brands and consumers. The results tell us loud and clear that brands must walk the talk, and consumers are one of the reasons for reviewing corporate ESG claims.” rely on others too much.

Consumers will readily make personal sacrifices for sustainability – but only up to a point

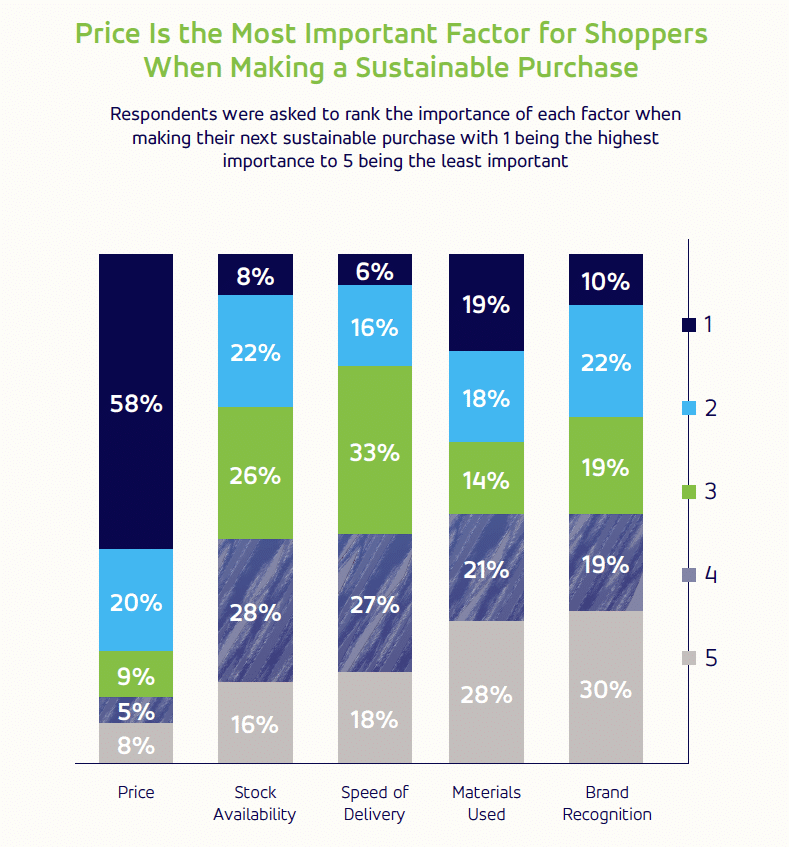

The findings suggest that consumers are willing to pay more and make personal sacrifices for more eco-friendly purchases, including delaying priority shipping. An impressive 69 percent said they would be willing to pay more for sustainable products, but this flexibility is not without limits – only 4 percent expressed a willingness to pay 20 percent more across all age groups. Willingness to pay 5 percent more was the top pick.

Inflation has topped out for many consumers, with 58 people across all age groups reporting that price was the most important factor in determining whether to make a sustainable purchase. Consumers were most liable to pay a premium for eco-friendly products, with apparel (30 percent), cleaning products (27 percent), and beauty products (19 percent) heavily impacting their daily lives. potential product.

While the last few years have sparked a great flood In e-commerce, consumers are more than happy to opt for non-prioritized, eco-conscious shipping speeds, and 78 percent would wait up to a week for delayed deliveries in favor of eco-friendly shipments. A whopping 86 percent were willing to delay their online shipping if they were given an incentive to do so. Of this group, 30 percent indicated they would wait a week or more, with the 18-29 demographic leading the way.

“The past year has also shown that consumers remain inflation-sensitive over the long term, with a significant shift in their willingness to spend and a clear trend in favor of older purchases,” Wong said. “As consumers navigate and weigh their options for more eco-conscious purchases, we can expect these patterns to continue across retail channels”

Other key findings:

resale item

When presented with a list of consumer goods that can be bought older, home furniture and appliances, apparel, and consumer electronics (in that order) were the top three for all age groups except 18-29, which ranked apparel first . Overall, a majority (54 percent) of respondents said they were most likely to buy resale home furniture and appliances, with consumer electronics coming in second and 45 percent indicating a willingness to buy secondhand.

eco-conscious habits

Thrifting secondhand clothing remains popular, with nearly one-third (31 percent; a significant increase compared to 23 percent) using it. reported last year, Looking at age, those 18-29 were more likely to participate in the practice, and those 60 and older were less likely. Recycling or composting was close behind, with 28 percent of all respondents citing that behavior as their top practice; However, it was down from 37 percent in 2022. Reusable bags remain popular among shoppers, with 24 percent ranking this habit as their most consistent eco-friendly practice, as of 2022.

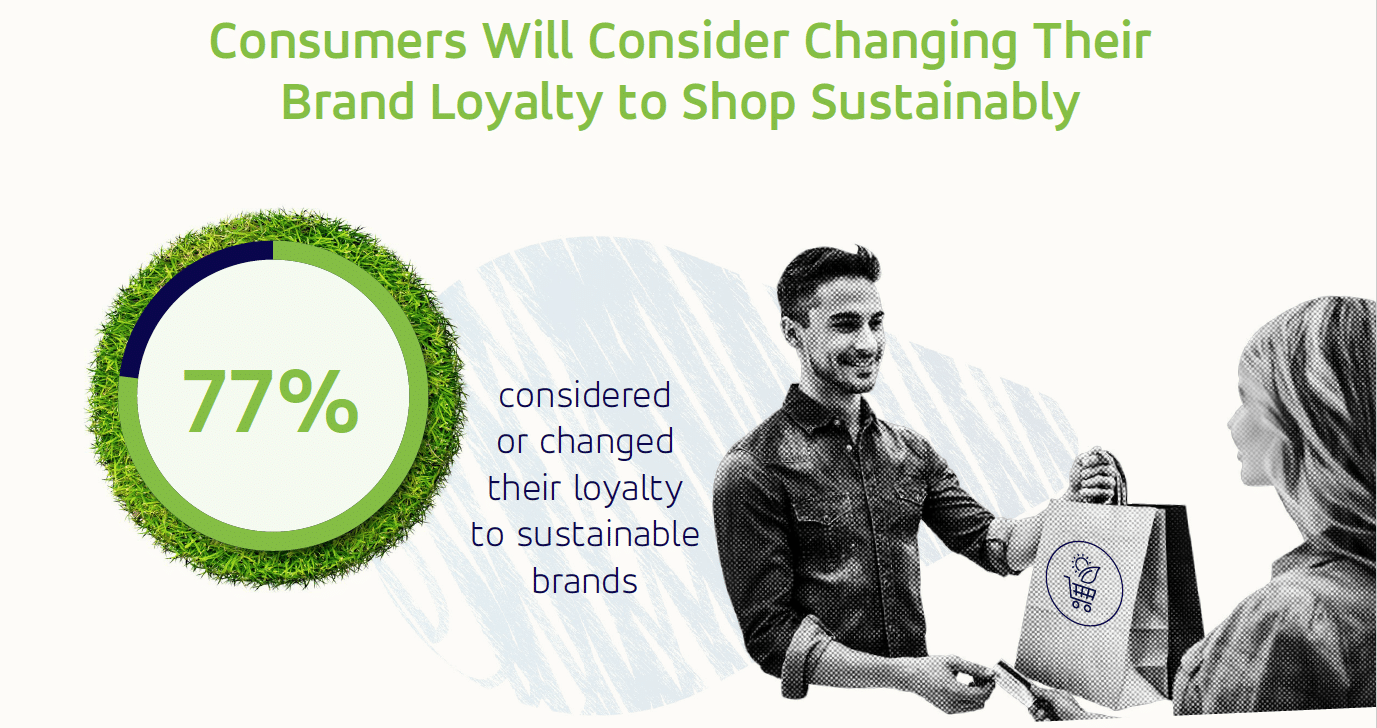

Loyalty

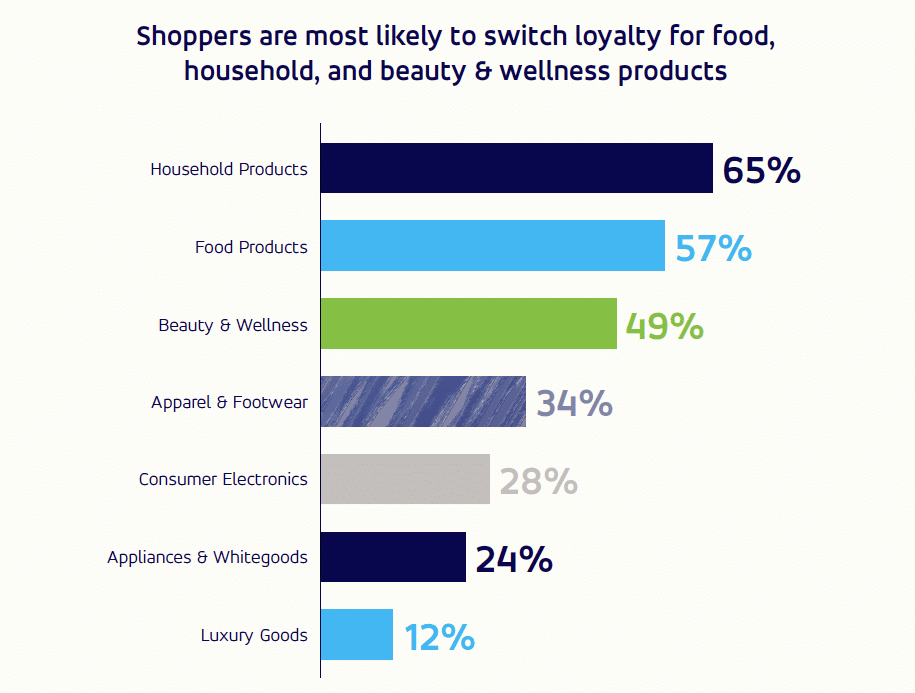

The top three overall categories of consumers who have switched allegiance or would consider switching were for household products (65 percent), food products (57 percent), and beauty and wellness (49 percent). Demographically, the domestic product ranked first for all age demographics except 60+, which ranked it second. Beauty stood second in the 18-29 age group, and third in the 30-44 and 45-60 age group. Only those aged 60+ ranked apparel and footwear in their top three.

Blue Yonder collected responses through a third-party provider for this Consumer Sustainability Survey from more than 1,000 US consumers ages 18 and older between February 17-19, 2023. This is the second year of the Blue Yonder survey.