UK growth forecast upgraded by IMF; John Allan to step down early as Barratt chair – business live | Business

Jeremy Hunt has announced that the International Monetary Fund had made a ‘big upgrade’ to the UK’s growth forecasts, following its annual healthcheck.

Hunt says:

“Today’s IMF report shows a big upgrade to the UK’s growth forecast and credits our action to restore stability and tame inflation.

“It praises our childcare reforms, the Windsor Framework and business investment incentives. If we stick to the plan, the IMF confirm our long-term growth prospects are stronger than in Germany, France and Italy – but the job is not done yet.”

The Fund is due to release its assessment of the UK economy at 11.15am, when we’ll her from Hunt and IMF chief Kristalina Georgieva.

But the news is already out – with multiple reports that the IMF is no longer expecting the UK to fall into recession this year.

Instead of shrinking by 0.3%, as the IMF forecast in April, the UK economy is now forecast to grow by 0.4% during 2023.

The Fund said the improved outlook reflected the unexpected resilience of demand, helped in part by faster than usual pay growth, the fall in soaring energy costs, improved business confidence and the normalisation of global supply chains.

“Declining energy prices and widening economic slack are expected to substantially reduce inflation to around 5 percent y/y by end-2023, and below the 2 percent target by mid-2025,” the IMF said.

The IMF forecast economic growth of 1% in 2024 and 2% in 2025 and 2026 before settling back to a long-run rate of around 1.5%.

Updated at 05.06 EDT

Key events

The IMF’s managing director, Kristalina Georgieva, says she had an ‘excellent meeting’ with Jeremy Hunt today, during the Fund’s visit to assess the UK economy.

Georgieva says the UK authorities have taken “decisive actions to promote macroeconomic and financial stability and are focused on the fight against inflation and on reforms to boost productivity, labor supply, and investment”.

Excellent meeting with UK Chancellor @Jeremy_Hunt in London today. The UK authorities have taken decisive actions to promote macroeconomic and financial stability and are focused on the fight against inflation and on reforms to boost productivity, labor supply, and investment. https://t.co/TuipC6Nl0K

— Kristalina Georgieva (@KGeorgieva) May 23, 2023

Jeremy Hunt has announced that the International Monetary Fund had made a ‘big upgrade’ to the UK’s growth forecasts, following its annual healthcheck.

Hunt says:

“Today’s IMF report shows a big upgrade to the UK’s growth forecast and credits our action to restore stability and tame inflation.

“It praises our childcare reforms, the Windsor Framework and business investment incentives. If we stick to the plan, the IMF confirm our long-term growth prospects are stronger than in Germany, France and Italy – but the job is not done yet.”

The Fund is due to release its assessment of the UK economy at 11.15am, when we’ll her from Hunt and IMF chief Kristalina Georgieva.

But the news is already out – with multiple reports that the IMF is no longer expecting the UK to fall into recession this year.

Instead of shrinking by 0.3%, as the IMF forecast in April, the UK economy is now forecast to grow by 0.4% during 2023.

The Fund said the improved outlook reflected the unexpected resilience of demand, helped in part by faster than usual pay growth, the fall in soaring energy costs, improved business confidence and the normalisation of global supply chains.

“Declining energy prices and widening economic slack are expected to substantially reduce inflation to around 5 percent y/y by end-2023, and below the 2 percent target by mid-2025,” the IMF said.

The IMF forecast economic growth of 1% in 2024 and 2% in 2025 and 2026 before settling back to a long-run rate of around 1.5%.

Updated at 05.06 EDT

Growth across UK companies is slowing this month, while firms are continuing to hike prices, according to the latest survey of purchasing managers.

UK economic growth remained centred on the service sector in May, data provider S&P Global reports, with travel, leisure and hospitality businesses benefiting from resilient consumer demand.

But production levels at manufacturing firms fell at the fastest pace in four months.

This pulled the S&P Global / CIPS flash UK composite output index down to 53.9 in May, from a 12-month high of 54.9 in April. Any reading over 50 shows growth.

Firms reported a fractional easing in input price inflation, thanks to a drop in energy bills and raw material costs for factories. But strong wage inflation pushed up costs for services firms.

The prices charged by private sector companies increased at an historically steep pace in May, although the rate of inflation was the second-lowest since August 2021.

This could spur the Bank of England into continuing to raise interest rates to squash inflation.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said the UK is seeing a tale of two economies, as manufacturing and services diverge:

“The UK economy enjoyed another month of strong growth in May, with the expansion continuing to be driven by surging post-pandemic demand in the service sector, notably from consumers and for financial services, with hospitality activities buoyed further by the Coronation. The surveys are consistent with GDP rising 0.4% in the second quarter after a 0.1% rise in the first quarter.

“However, this growth spurt is driving renewed inflationary pressures, as service providers struggle to meet demand and hence not only offer higher wages to attract staff but also find themselves able to charge more for their services.

It’s a different story in manufacturing, where spending is being diverted away from goods to services, and many companies are also winding down their inventories, exacerbating the downturn in demand and driving both output and prices lower.

Updated at 04.49 EDT

The government pulled in more money from inheritance tax last month.

New data from HMRC show that inheritance tax receipts rose to £600m in April, which is £100m higher than a year ago.

Alex Davies, CEO and Founder of Wealth Club said:

“The 2023/24 tax year is looking likely to be yet another record-breaking year for inheritance tax. It really is a cash cow for HMRC.

Currently, people can pass on up to £325,000 of their estate without them having to pay any IHT. Anything above £325,000 could be subject to up to 40% inheritance tax. The nil-rate band has stayed at the same level since April 2009, although asset prices (such as houses) have risen since.

Dean Moore, Managing Director and Head of Wealth Planning at RBC Wealth Management, says the freeze on inheritance tax thresholds is pushing up IHT receipts.

The burden of IHT on families is reaching unprecedented levels, with a projected record payment of £6.7 billion in the financial year 2022/23. This amount is more than double the £2.9 billion paid in 2011/12, and it is expected to further increase to £7.8 billion within the next five years.

“The significant rise in IHT is primarily driven by sustained increases in property prices and the long-term freeze of the IHT threshold which is unchanged at £325,000 since 2009. Meanwhile, average house prices in London have increased from £245,000 to £532,000 over the same period. (Source: Land registry).

“The current state of IHT places a substantial financial strain on the loved ones left behind after a person’s passing. In response, individuals are increasingly resorting to measures such as gifting, investing, donating, and insuring their money to minimise or avoid this tax.

“Failing to promptly and effectively address the issue of IHT can lead to families facing overwhelming administrative and financial burdens during a time of already profound emotional stress. By adopting a proactive and incremental approach to IHT, the process can be made significantly easier, alleviating the strain on those who are grieving the loss of a loved one.”

Updated at 04.18 EDT

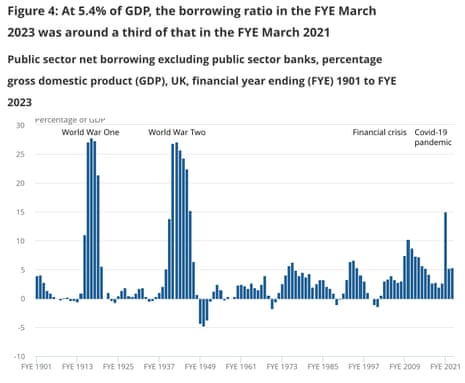

Here’s a handy chart from today’s April public finances, showing UK public sector borrowing as a proportion of GDP.

Photograph: ONS

Photograph: ONS

As you can see, the Covid-19 pandemic pushed up borrowing in the 2020-21 financial year to 15%, the highest for 75 years.

Shares in Pennon Group, which owns South West Water, have dropped over 2.5% this morning after regulators launched an enforcement probe into water leakage.

Pennon told shareholders that Ofwat have announced an investigation into South West Water’s 2021/22 operational performance data relating to leakage and per capita consumption.

Pennon says:

This operational performance data was reported in South West Water’s Annual Performance Report 2021/22. This report is subject to rigorous assurance processes which include independent checks and balances carried out by external technical auditor.

We will work openly and constructively with Ofwat to comply with the formal notice issued to South West Water as part of this investigation.

Pennon shares are down 2.75% at 799.5p, trading at their lowest since the start of March, among the biggest fallers on the FTSE 250 index of medium-sized companies.

My colleague Nils Pratley has written about how the water industry is trying to avoid being held fully to account for the failures to invest properly over recent decades.

Here’s a flavour:

We want to be held to account …” said Ruth Kelly, the new public face of the English water companies, last week, briefly raising hopes of a moment of reckoning for the industry’s past (and current) sewage spills. Then the chair of Water UK clarified what her version of accountability covers. The companies wish to be held to account “… for putting it right”.

The past 30 years, we were invited to think, should be considered an unfortunate chapter in which the industry, terribly unfortunately, didn’t give sewage spills enough attention while other investments were prioritised. That was the gist of her apology. “By and large, the water companies were carrying out their legal responsibilities but … what’s legal is not necessarily the right answer or what people expect,” she argued on BBC Radio 4’s Today programme.

One trusts this “by and large” claim provoked spluttering among officials at the Environment Agency and Ofwat. As Kelly must know, both regulatory bodies have been engaged for the past 18 months in an inquiry to determine whether the industry was, in essence, not treating as much sewage as it should have been at 2,000-plus treatment plants. Whether legal duties were met is very much a live question….

April’s public finances figures have got the new fiscal year off to “a shaky start”, say Capital Economics.

After one month of the 2023/24 fiscal year, the Chancellor is already on track to overshoot the OBR’s full-year borrowing forecast of £132bn (5.1% of GDP) by about £3.2bn, says Ruth Gregory, their deputy chief UK economist.

Gregory explains:

Revisions to past data meant that public sector net borrowing in the 2022/23 financial year was revised down from £139.2bn (5.5% of GDP) to £137.1bn (5.4% of GDP). But the government borrowed more than expected in April.

Borrowing was £25.6bn in April, bigger than the OBR forecast and consensus forecast of £22.4bn and £11.9bn above last April’s outturn. Given the recent resilience in the economy, weaker-than-expected receipts was a little surprising. At £69.7bn, total receipts were well below the £72.2bn the OBR forecast.

A fair chunk of the overshoot also reflected higher total expenditure of £89.2bn (OBR forecast £83.5bn) as recent rises in RPI inflation (to which index-linked gilts are pegged) caused debt interest payments of £9.8bn, the highest April figure since records began in 1997 (the cost of energy support schemes was in line the OBR forecast).

But, Capital Economics doubts this will prevent the Chancellor from embarking on a fiscal splurge ahead of the next election.

Updated at 03.39 EDT

Today’s public finances data shows that the UK national debt was almost as large as the country’s annual economic output.

Public sector net debt at the end of April 2023 was £2,536.9bn or around 99.2% of gross domestic product (GDP).

The current debt-to-GDP ratio is at levels last seen in the early 1960s.

Public sector debt excluding public sector banks was £2,536.9 billion at the end of April 2023.

Around 99.2% of gross domestic product, with the debt-to-GDP ratio at levels last seen in the early 1960s.

— Office for National Statistics (ONS) (@ONS) May 23, 2023

Mark Sweney

French billionaire Patrick Drahi has increased his stake in BT to more than 24%, but re-iterated that he does not intend to make a bid for the £15bn British telecoms giant.

Drahi, who controls an 18% stake through subsidiary Altice UK, raised his position to 24.5% on Tuesday, my colleague Mark Sweney writes.

The move comes days after BT announced a major restructuring to become a “leaner businesss” that will see workforce cut by as much as 55,000 by 2030.

The cuts will come from a combination of natural attrition, cutting contractors at the end of the build phase rolling out fibre broadband and 5G mobile networks nationwide, and a move into AI which could replace about 10,000 jobs.

The company said:

“Altice UK has restated its position to the board of BT that it does not intend to make an offer for BT.”

Drahi’s investment vehicle first bought a 12 per cent stake in BT in June 2021, increasing it to 18 per cent later that year.

The UK government moved to examine Drahi’s stake under new tougher new powers to potential block the takeover of key national assets under the National Security & Investments Act.

Victoria Scholar, head of investment at interactive investor, tells us:

Last week BT’s earnings sent shares sharply lower. Clearly Altice UK judged that now is an opportune moment to acquire further shares at an attractive price with the stock down several percent since last week. In June 2021, billionaire Drahi paid around £2.2 billion for a 12.1% stake in BT. In December that year, his company Altice UK raised the holding to 18% at a price tag of roughly another £1 billion. Last year the UK government gave the green light to Drahi’s stake building, ruling that it didn’t pose a national security threat.

BT’s results last week highlighted the pressures facing the business with falling free cash flow and plans to slash 55,000 jobs. It has been dealing with costs pressures from inflation and energy bills as well as capital expenditure on its national fibre network rollout. Altice UK’s stake building provides a vote of confidence in BT but there are questions about what changes Drahi may want to implement to the business. Perhaps he could push for more aggressive cost cuts at BT.

Grocery price inflation has fallen for the second month in a row – but is still adding an extra £833 to the average consumer’s annual bill, according to latest figures.

Prices over the four weeks to May 14 were 17.2% higher than a year ago, down from April’s 17.3%, data firm Kantar reports this morning.

Kantar points out that price rises are still incredibly high – 17.2% is the third fastest rate of grocery inflation reported since 2008.

Fraser McKevitt, head of retail and consumer insight at Kantar’s Worldpanel Division, explains:

This could add an extra £833 to the average household’s annual grocery bill if consumers don’t shop in different ways

Kantar also reports that the average cost of four pints of milk has come down by 8p since last month, but is still 30p higher than this time last year at £1.60. Several supermarket chains have trumpeted price cuts for milk recently.

Kantar also reports that more consumers are turning to supermarket own-brand products in a bid to keep their bills under control. Sales of the cheapest own-label products soared by 15.2% over the past month, almost double the 8.3% increase seen for branded products.

Although borrowing jumped in April, the UK actually borrowed less than previously thought in the previous financial year.

The ONS revised down its estimate for the budget deficit in the 2022/23 financial year that ended in March to £137.1bn, down from £139.2bn previously.

On this morning’s jump in UK borrowing, Chancellor of the Exchequer Jeremy Hunt says:

“It is right we borrowed billions to protect families and businesses against the impacts of the pandemic and Putin’s energy crisis.

“But debt and borrowing remain too high now – which is why it’s one of our priorities to get debt falling.

“We’ve taken difficult but necessary decisions to balance the nation’s books, and if we stick to our plan and get our economy growing, then debt is set to fall.”

John Allan says he regrets having to step down early at Barratt.

In a statement reported by PA Media, Allan said:

“It is with regret that at the request of the board I am stepping down as chairman of Barratt Developments Plc as of June 30 2023, ahead of finishing my tenure in early September as planned.

“My early departure from Barratt is a result of the anonymous and unsubstantiated allegations made against me, as reported in the Guardian which I vehemently deny.”

Outgoing Tesco chairman John Allan is stepping down from his role chairing housebuilder Barratt Developments earlier than planned, at the request of the board.

Barratt told the City this morning that Allan will step down as Chair of the Board and as a Director of the Company from 30 June 2023.

Allan had been expected to step down in September, to be replaced by non-executive director Caroline Silver, but this plan – announced in January – has been brought forward.

Barratt told shareholders that they had decided to speed up the transition to prevent allegations made against Allan from becoming disruptive to the company, saying:

At the request of the Board, John Allan will step down as Chair of the Board and as a Director of the Company on 30 June 2023.

The Board believes it is in the best interests of Barratt to accelerate the planned transition to the new Chair of the Board to prevent the ongoing impact of the allegations against John from becoming disruptive to the Company.

Barratt added that it has not received any complaints about John Allan during his tenure at the company, which he joined in 2014.

Last Friday, Tesco announced that Allan would step down in June, after the Guardian reported that Allan allegedly touched the bottom of a senior member of Tesco staff in June 2022, at the company’s last AGM.

Four allegations about Allan emerged during the Guardian’s investigation into the Confederation of British Industry (CBI) – the UK’s foremost business lobbying group.

Allan was president of the organisation between 2018 and 2020 and then vice-president until October 2021.

He has denied three of the four claims made against him. He has admitted making a comment about a CBI staffer’s appearance that she found to be offensive in 2019, and apologised for the remark.

Barratt senior independent director, Jock Lennox, says:

“The Board is grateful to John for his nine years of service to Barratt. He leaves the Company in a strong financial and operational position, continuing to perform well in challenging market conditions.”

Updated at 02.54 EDT

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Britain borrowed more than £25bn to balance the books last month, the second-highest borrowing for an April ever, and more than expected.

Soaring inflation and the cost of capping energy bills drove up borrowing again, the latest figures from the Office for National Statistics show.

Borrowing hit £25.6bn last month, which is £11.9bn higher than in April 2022, and the second highest since monthly records began in 1993 (behind April 2020, when the pandemic hit the economy).

Economists polled by Reuters had predicted that public sector net borrowing, excluding the impact of state-owned bank, would have hit £19.75bn in April.

Public sector net borrowing (excluding public sector banks) was £25.6 billion in April 2023.

The second highest April borrowing since records began, largely due to:

▪️ the cost of energy support schemes▪️ increased benefit payments

▪️ debt interest

— Office for National Statistics (ONS) (@ONS) May 23, 2023

Although public sector receipts rose by £900m in April compared with March, that was dwarfed by a £12.8bn rise in public sector spending.

High inflation continued to drive up the cost of the national debt, as many government bonds are pegged to the rising cost of living.

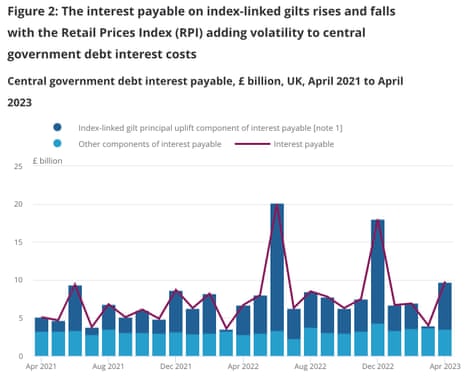

The interest payable on central government debt jumped to £9.8bn in April, a jump of £3.1bn compared with April 2022. Thas was due to the increase in the RPI measure of inflation.

The ONS explains:

Rises in the Retail Prices Index have increased the interest payable on index-linked gilts. This represents the third-highest interest payable in any month on record, behind the £20.0bn in June 2022 and the £18.0bn in December 2022.

Photograph: ONS

Photograph: ONS

The UK’s energy support packages meant central government spent £3.9bn on subsidies, £1.8bn more than in the April 2022.

Most of that increase was due to the cost of the Energy Price Guarantee for households and the Energy Bills Discount Scheme.

Also coming up today

The UK economy, and its policymakers, are in the spotlight today.

A team from the International Monetary Fund are in London to give their annual healthcheck on Britain’s economy.

The IMF will give its verdict after meetings with the Bank of England, the Treasury, independent watchdogs at the Office for Budget Responsibility and the Financial Conduct Authority.

Last month the IMF forecast that UK GDP would shrink by 0.3% this year, the weakest of all major industrialised countries.

But chancellor Jeremy Hunt has vowed to beat these forecasts, and earlier this month the Bank of England upgraded its own estimates due to a brightening economic outlook.

Hunt, and IMF managing director Kristalina Georgieva, will hold a press conference to discuss the report this morning, from 11.15am.

MPs on the Treasury Committee will quiz top officials from the Bank of England this morning too.

The Governor of the Bank of England, Andrew Bailey, chief economist Huw Pill, and Monetary Policy Committee members Catherine Mann and Silvana Tenreyro will be questioned about this month’s interest rate rise to 4.5%, the highest since 2008.

Huw Pill’s recent comment that British households and businesses “need to accept” they are poorer may come up too….

The agenda

-

8am BST: Kantar grocery survey

-

9am BST: Eurozone flash PMI surveys for May

-

9.30am BST: UK flash PMI surveys for May

-

10.15am BST: Treasury Committee hearing with the Bank of England over monetary policy.

-

11.15am BST: IMF 2023 Article IV end-of-mission press conference in London.

Updated at 03.14 EDT