Advertising Disclosure

This article/post contains references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services

In my opinion, YNAB, which stands for You Need a Budget, is the best budgeting app on the market. And I don’t say that lightly – I’m a budgeting software nerd. I’ve tried them all and YNAB is the software I use in my daily life. The YNAB budgeting system will change the way you think about your money.

The point of budgeting software is to help you make spending decisions and plan for the future. That’s exactly what YNAB does.

Pros & Cons

pros

- 34-day free trial

- Available on multiple platforms and has a mobile app

- Easy to use once it’s up and running

- Great for couples

cons

- Limited reporting

- No account alerts

- Learning curve when starting

What Is YNAB?

You Need a Budget (YNAB) is a budgeting app that allows you to plan your spending for the upcoming month, and then assign transactions to the various categories. This gives you a snapshot of exactly how much you have left to spend in each category as the month goes on.

It connects to your bank account and automatically pulls in your transactions from your linked accounts. You can easily categorize each transaction so your budget is always up to date.

You can also share access with a partner. So it’s great for couples who want to stay on the same page.

The app offers not just the mechanics of monitoring income and expenses, but also provides instructional support to help you deal with the root causes of financial distress. It’s an example of an app that does one thing and does it extremely well.

YNAB Features

| Price | Min: $99, Max: $99, Term: year |

| Budgeting | |

| Bill Payment | |

| Investment Tracking | |

| Access | Web Based, iOS, Android |

| Credit Score Monitoring | |

| Bill Management | |

| Retirement Planning | |

| Tax Reporting | |

| Reconcile Transactions | |

| Custom Categories | |

| Import QFX, QIF Files | |

| Two-Factor Authentication | |

| Online Synchronization |

How YNAB is Different: The Four Rules

YNAB is different than other budgeting software because it isn’t about what has happened in the past. You don’t just pull a report at the end of the month to see how you did. You actively plan and track throughout the month so you stay in control of your expenses.

How they are different really comes out in their four rules for budgeting:

Give Every Dollar a Job

Giving every dollar a job means putting each and every dollar into a budgeting category. So every time a dollar comes into your account, you’ll assign it to a category. This is called “zero based budgeting”.

Then every dollar that is spent will also be assigned to a category.

This helps you stay on top of your spending and you’ll always know exactly where you are and what you still have to spend.

Embrace Your True Expenses

Budgeting is more than just tracking your regular monthly expenses. One of YNAB’s great features is how they use sinking funds. A sinking fund is a pile of money that you can add to and spend from as you go along. It’s perfect for expenses that aren’t exactly the same every month — like gift giving for example. You can figure out how much you spend each year for gifts and then budget 1/12th of that each month. As the year goes along you are funding your Gift budget but also spending as needed.

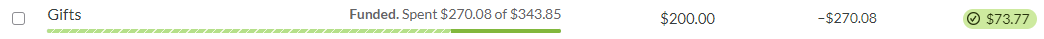

For example, here I’ve allocated $200 a month to gifts and you see how that works over three months.

In January, I allocated $200 to gifts and spent $56.15. Leaving me $143.85 left (in green), which rolled over into Feburary.

In February, I allocated another $200 to gifts and spent $270.08. Leaving me with $73.77 left, which rolled over into March.

In March, another $200 went to gifts but I didn’t buy any. So $273.77 rolled over to April.

In April, I would allocate another $200 giving me a total of $473.77 to spend if I wanted to. As the year progresses, I’ll be building up for a big lump sum to spend for Christmas, then we will start over again next year.

But this works with all kinds of expenses. Any categories you don’t spend on an even month to month basis, like car repairs or medical expenses. Some months are more expensive than others so but if you can budget a flat amount each month you’ll be able to absorb those bigger months without it impacting your whole budget.

Roll with the Punches

Rolling with the punches is YNAB’s way of saying be flexible. YNAB makes it really easy to reallocate money as needed.

Let’s say you budgeted $500 a month for groceries but you’ve spent it all and it’s only the 20th. You know you’ll need $100 to go grocery shopping at least one more time to make it through the month. With YNAB you can easily see if there is a category that has any left over funds that you can move into groceries.

Simply click on the green section and you’ll get a drop down box where you can choose the amount you’d like to move an the category you’d like to move it to. Here I’m moving $100 from my Restaurant budget to groceries.

Of course, there are real life consequences to going over budget. If I needed that money for going to restaurants then I’ll just be putting myself in a sticky spot later. But the longer you budget for the better you’ll get at predicting your spending and the smoother your budget will get.

Note that you can see in this screenshot that I budgeted $250 for restaurants but actually had $322.21 to spend. This is because I was under budget last month and the excess rolled over. In this case I could move $100 into groceries without impacting my budget too much since I had extra in there. A benefit of being under budget that you don’t get with other budgeting software. With YNAB you can really see how your everyday choices impact your finances.

Age your money

I personally think this rule is hardest to understand but it is the most impactful once you see it in action.

The idea is to stop living paycheck to paycheck by living on last month’s income. When income hits your bank account you can allocate it to next month’s budget. This means you start each month with a fully funded budget.

This stops the paycheck to paycheck cycle, no longer do you have to wait for your next paycheck to pay a bill or do that car repair.

If you’ve never had any flex in your budget it’s difficult to imagine. But YNAB will help get you there though it’s system. As you budget you’ll be thinking ahead and using sinking funds to smooth out your budget. As you go along you will slowly get farther and farther ahead until you are a full month ahead in your budgeting.

YNAB Community

Budgeting with YNAB is probably unlike any type of budgeting you’ve done before. Therefore, getting started with this app isn’t exactly easy. From a technical standpoint it’s very easy to sign up and link your financial accounts — but it’s likely a big mental shift from how you’ve budgeted in the past. So you might need some help.

I mean, I’m a budgeting nerd and I needed help.

Luckily, there is plenty of help. YNAB has an extensive help section on their website as well as a podcast and YouTube channel. There are also community driven groups on Facebook and Reddit.

YNAB has an extensive and active community. If you have questions there is no doubt someone who can help.

YNAB’s Budgeting Features

Real-time Syncing

When you link your spending accounts, your budget will always be up to date across all devices, so you can access your budget anywhere, anytime.

If your co-workers invite you to lunch you can check the YNAB app and see where you stand.

For example, you’ve budgeted $200 for restaurants and see you’ve already spent $199 you may decide to skip. If you’ve spent $150, you may decide to go.

But it’s also flexible. Let’s say you’ve spent $199 of your restaurant budget… but you have $40 left over in gas and you have a full tank that will last you the rest of the month. You may decide to move some of that money out of gas and into restaurant so you join your friends.

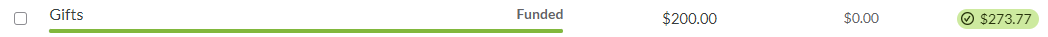

Goal tracking

As you set up your budget you can set goals for different categories, such as saving for a vacation or paying off debt, and track your progress towards those goals.

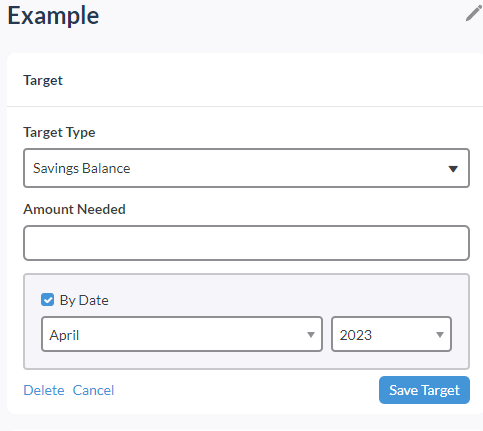

When you set up a new budget category you have the option to set a goal. You have four goal options.

You can save up for a spending goal, like saving for a vacation. You can work to build up your savings account to a specific amount. You can just get a goal to save a certain amount each month. Or you can set a debt payoff amount.

This goal will be in your budget and available to you to allocate your income to when it hits your account.

Here I chose ” Savings Balance” and I can indicate how much I’d like to have saved and by what date. The system will automatically set the monthly amount needed to reach that goal and it will appear as a line in my budget.

Expense Tracking

Deciding how you want to spend your money is half of budgeting. The other half is making sure your money is actually spent according to the plan. YNAB helps you track your expenses and categorize them to see where your money is going.

It’s quite easy to do and take me about 10 mins a week to categorize all my expenses. Most come through already categorized and I just have to approve them.

Here’s what that looks like:

You can see the top one is bold, that one needs approval. It wasn’t automatically categorized so I’ll just click on that yellow highlight and choose which category it belongs in.

There is also a place to write notes, which is super handy. If I don’t know what something is I can leave a note for my husband. Or if you want to keep track of different payments you can make notes to yourself for future reference.

You can also split transactions. So say you spent $40 on Amazon and $10 was groceries and $30 was household items. You can split that right on the transaction screen.

Reports

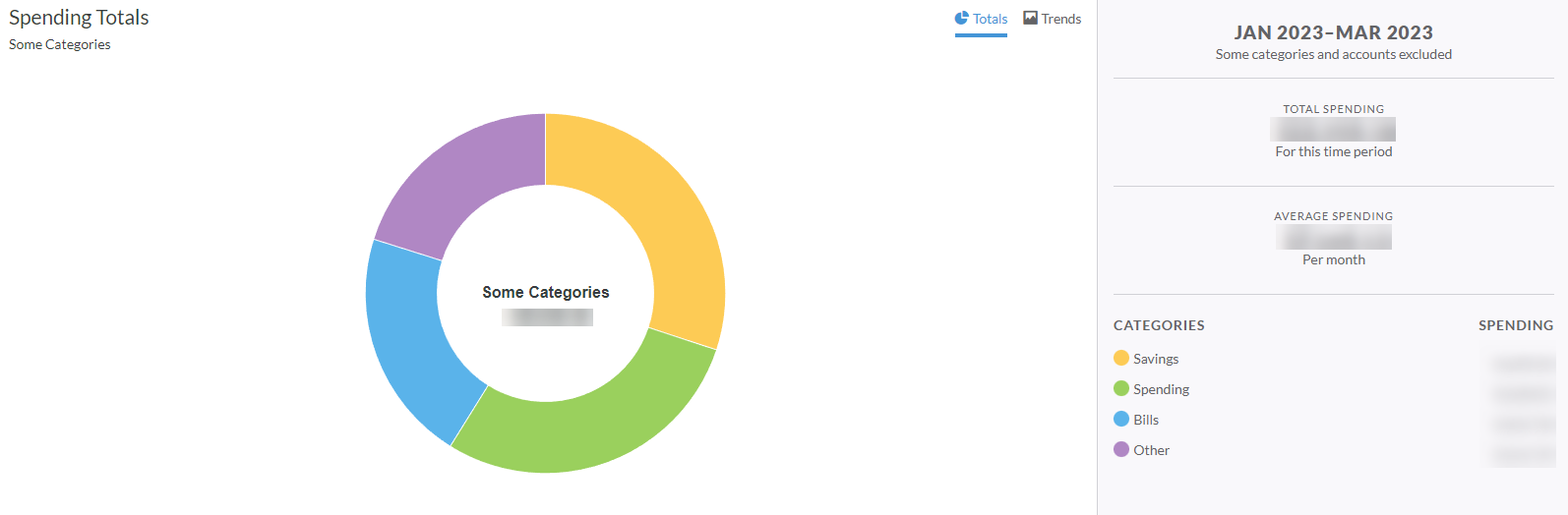

I will say that I don’t use the reporting section of YNAB, and therefore my accounts are not set up to be very friendly for reporting.

Here’s my spending reports for the first three months of 2023.

Obviously, I have the numbers blurred. However, even with the numbers it’s not especially helpful or interesting.

How you set up YNAB will affect these reports, I’m sure if I wanted to see more in the reports I could do a better job of setting it up so I get the information I want.

For example, I only break my transactions up into “Bills”, “Spending”, “Savings” and “Other”. Under the bills section I have a subcategory for each bill, such as AT&T and Netflix. My spending subcategories are things like Groceries and Gas.

If you wanted more detailed reports you could break it up further by creating smaller categories such as “Transportation” or “Food” and you’d have more detailed reports.

If reporting is important for you, think about that as you are setting up your budgeting categories.

YNAB Subscription Pricing

YNAB is not free and it’s actually on the expensive side when it comes to budgeting apps.

YNAB is $14.99 per month if you pay monthly. Or $99 per year if you pay annually.

They do offer a 34-day free trial to help you decide if you like the service. They won’t collect your credit card information during the free trial because, in their words, “It’s lame when companies do that.”

Is YNAB Worth It?

I absolutely think YNAB is worth it, after all, I use it myself. The average user saves $6,000 in the first year of using YNAB. So I’m not the only one getting a lot of value out of this budgeting app.

How to Set up Your YNAB Account

YNAB is easy to set up, but hard to use at first. Once you are set up and going along you’ll see how easy it is. But because it’s unlike any budgeting you’ve done before there is a bit of a learning curve.

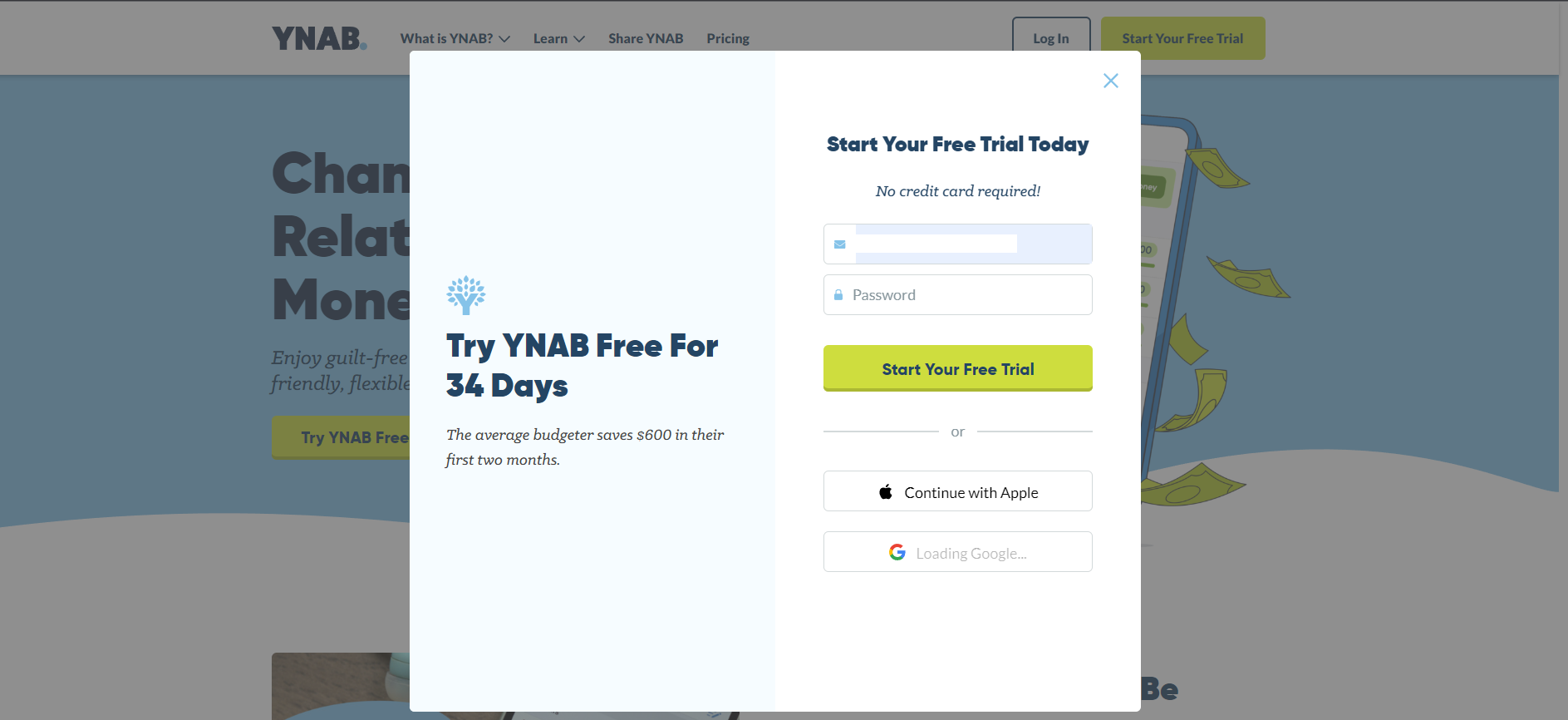

Sign up

They offer a 34 day free trial and do not require you to enter a credit card to try it out. So it’s totally risk free. If you decide that YNAB is not for you there is nothing for you to do. No need to cancel.

To get started, go to the YNAB website and click “Start Your Free Trial” in the top right of the screen. A pop up will appear for you to enter your email and create a password.

Once you do that, you’ll have agree to their terms of service.

Next, you’ll jump right into building your budget.

It starts with some basic default budget categories and subcategories. Start filling out some of the things you spend money on. You don’t have to think of every single thing right now. Just add a few basic items to get the hang of adding categories. You have plenty of time to make adjustments later.

This is fully customizable so feel free to make it your own. However you want to set it up is great.

Here’s a tip: If it’s the middle of the month only budget what you will spend in this calendar month going forward. When you start a fresh month you can start thinking about the whole month. I started in the middle of the month and I was very confused for the first few weeks.

Once you’ve added a few spending categories you can link your bank accounts.

You can add your accounts by click on “Add Account” in the top left.

Add any accounts you use for spending, which will include checking accounts, credit cards, etc. However, I would avoid adding savings accounts.

I added a savings account when I first started and when I moved money into savings it wasn’t behaving how I expected. YNAB treats all accounts as spending accounts, so it was still saying I had the money to spend, even after I had moved it to savings.

Once I removed my savings account things made a lot more sense. I could move money into savings and it would show that that money had been removed from my budget, which is what I intended.

You can also set up “Asset Accounts” which work differently than spending accounts. Here is where you can track your balances of your savings and investment accounts.

You can also add “Debt Accounts” where you can track your debt balances. I haven’t added either of these types of accounts. YNAB is a budgeting app at it’s heart and I’ve chosen to use it as such and track my savings and debt balances in other places.

If you aren’t sure how you’d like to use YNAB I’d leave these off for now and add them later if you choose to. Keep it simple while you are learning how to use YNAB.

After you’ve linked your accounts your current balances will be ready to assign to your budget. In this example, I added a checking account that has $2,000 ready for me to assign.

Keep in mind, you can only assign what is actually in your account and you’ll be working on a calendar month basis. So assign spending categories based on how you will be spending your money for the rest of this calendar month.

Here I’ve assigned all $2,000 based on my planned spending for the rest of this month.

Then you are ready to start categorizing transactions as they come in and working your plan.

Tips for Success with YNAB

Commit to Three Months

This is true for any new budgeting system. It takes a while to work out the kinks. So if you are new to YNAB, or to budgeting in general, it’s going to take a few tries before you feel like you know what you are doing.

Don’t let a bumpy first month make you feel like you can’t budget. It just takes time to learn this new skill. I’ve never met anyone who gets right immediately.

I’ve been budgeting my whole adult life and it wasn’t until my fourth month that I felt like I was confident in my YNAB skills.

Ask for Help

Again with the theme that there is a steep learning curve here. Don’t be afraid to ask for help. You’ll have questions, everyone does. That’s ok. Join a YNAB community group on Facebook or Reddit. Or contact YNAB customer support and ask away.

YNAB has a committed user base. You are bound to get your questions answered. And you might pick up some budgeting hacks you hadn’t considered before.

Keep it Simple

When you are first starting, I recommend using broader categories and then breaking them later if you find you need to. That way you can start to get the hang of YNAB without worrying about whether buying laundry detergent counts and groceries or not.

If you find you are overspending a lot in a category then you can break that down further to try to identify the issue.

For example, if you have a general “Food” category that you keep exceeding, then break it down into groceries and restaurants. You might find out you are eating out more than you realized. Or you might realize you buy a lot of groceries that you just end up throwing away because you are too tired to cook.

Budget in Some Slack

I have a category called “Buffer”. I’ve seen other users call it “Stuff I forgot to budget for”. You’ll never have a perfect month of budgeting where there are no surprises, no overages, no mistakes.

As you figure out your spending habits you’ll start to get an idea of how much slack you need in your budget. Just plan for that unexpected expense and then it won’t be so stressful.

YNAB Alternatives

You Need a Budget certainly isn’t for everyone. If you want more reporting, forecasting, or investment and net worth tracking then you may be looking for a different service.

Here are some other budgeting apps.

Simplifi

Simplifi by Quicken is a budgeting tool from Intuit, the same company that makes Quickbooks and TurboTax.

It has a lot of similarities with YNAB in that it allows you to set up your monthly budget and link your bank accounts so you can easily categorize your transactions.

It also has deeper reporting features than YNAB. It also offers more options for tracking your investments and net worth.

It costs $5.99 if you pay monthly or $35.88 annually.

Check out our full Simplifi review.

Pocketsmith

PocketSmith links to your bank accounts and allows you to categorize your transactions against your budget. But it also goes deep into forecasting – in fact, on the Super level plan (the most expensive) you actually get forecasting over 30 years. This really shows you how small changes to your finances can make an impact over time.

Users also report loving how it shows all your bills in a calendar view so you can always see what exactly is coming up. It’s a very forward thinking budgeting tool.

Pocketsmith has a free plan if you want to check it out and see how you like it – however you can’t link your bank accounts on the free plan.

There are two levels of paid plans, Premium and Super.

Premium costs $9.95 per month if you pay monthly or $90 per year if you pay annually. You’ll get 10 year forecasting with this plan.

Super costs $19.95 if you pay per month or $169.92 if pay annually. You’ll get 30 years of forecasting with this plan.

Check out our full Pocketsmith review.

Summary

Hopefully this YNAB review helped you decide if this is the budgeting app for you. If you are ready to truly take control of your money then YNAB is definitely worth a try.

It’s biggest strength how the budget categories roll over from month to month. This allows it to handle expenses that don’t happen every single month really well. You can’t forget to plan for them and when they do pop up you don’t have to scramble. It’s biggest strength how the budget categories roll over from month to month. This allows it to handle expenses that don’t happen every single month really well. You can’t forget to plan for them and when they do pop up you don’t have to scramble.