Sheet

1,000 VC Firms

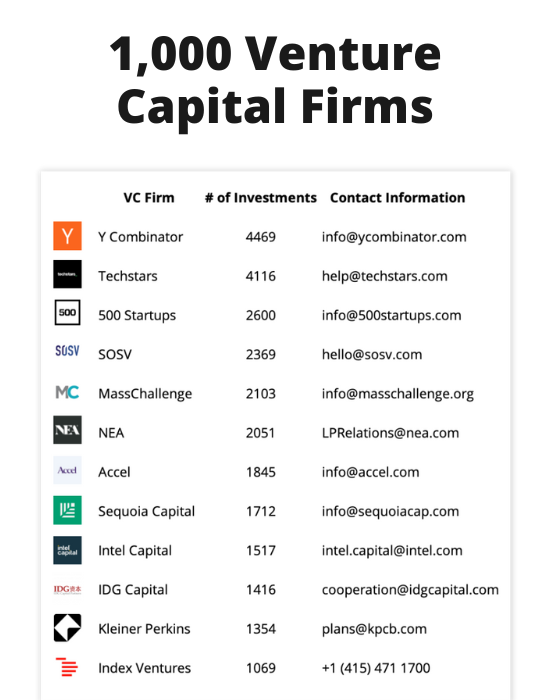

Information about the countries, cities, stages, and industries they invest in, as well as their contact details.

Get the Sheet for $50

By this stage of your startup, it’s possible to say you’ve built game-changing technology and a high-performing organization with the muscles to build and distribute innovative products globally.

This guide will review how you can now raise a Series D round. We’ll cover what Series D financing is, when and how much to raise, how long it should last, some funding sources, and some examples.

What is Series D Financing?

Series D financing is traditionally the last private investment into your company after it raises a Series C. For most startups, this is the last round of the “growth-stage” rounds before they get acquired or enter the public markets.

Overall the process is similar to the previous growth-stage rounds, just with larger checks. You’ll pitch to various growth-stage investors that your startup has enough traction to merit the billion-dollar valuation of a unicorn and that you’re ready to prepare for exit or acquisition.

Investors will go through an internal due diligence process to get conviction around your company, and if there’s interest, they’ll send you a term sheet. Lastly, you’ll get a wire for the amount to your checking account and get back to work on penetrating the last of the market share and getting ready to exit.

Typically, Series D funds are used for:

- Hitting the last growth goals from your financial planning to optimize for an exit scenario by either acquisition to a large corporation or via the public markets (IPO).

- Acquiring other startups that might be useful to create exit hype.

- Recruit the services of an investment bank and other underwriting contractors like lawyers, public accountants, and regulatory specialists that focus on IPOs or acquisitions.

- Less commonly, to create comparable stock prices to facilitate the merger with a competitor or adjacent company to consolidate market share.

In Series D, all metrics and financial reporting must not only be trending towards exit potential but pass serious regulatory and other best practices. Investors at this stage are well versed in exiting, so don’t be surprised if their level of due diligence is on par with what the securities and exchanges commission (SEC) expects for financial reporting. This is key for guaranteeing liquidity and healthy profits for the investments but also for your and the rest of your team’s equity.

When to Raise Series D?

It’s recommended that you start raising your Series D 18- 24 months before you’ve run out of money from your Series C. This will give you, your team, and your board enough time to pitch your existing and new investors that you’re tracking towards exit-worthy revenue growth. Although cyclical, the macroeconomic climate from the public market or potential acquirers is difficult to predict, so you want to ensure you’re tuning into weather reports in case of a storm.

Pre-empting funding offers, which we covered extensively in our Series C guide, also occur in Series D. So just be prepared if an existing investor comes with a term sheet before you even start your formal process.

In an elegant analogy, a growth-stage Series D is like flying a large cargo plane. You might have a lot of fuel, but there are few potential airports with landing ramps (exit paths) that are viable for you to land on.

Going bankrupt due to bad exit-planning planning when you’ve succeeded in building an innovative product, and high-performance organization is a catastrophic failure scenario you cannot afford to make.

How Does Series D Funding Work?

The first principles of Series D are more or less the same as other priced equity fundraising rounds we’ve covered in other guides. You’ll evaluate pre-emptive term sheets from existing investors or pitch to multiple investors, you’ll go through their evaluation process, and if they decide to invest, you’ll negotiate terms.

The due-diligence process for Series D is where rockstar CFOs are worth their weight in gold. Investors at these stages prioritize exit readiness above all else. They want to feel confident that you’re ready to exit and that if you’re not, you can be ready using the funds. Having a CFO with experience taking startups public or managing late-stage acquisitions will leave investors feeling relaxed enough to secure a term sheet.

Your previous Series C investors have information rights to your financials. At Series D, investors have their analysts making comprehensive exit models with your financials. Exit models are possible valuations by either the public markets or acquires for your startups. These valuations matter greatly to investors as they are trying to maximize returns. If, during the due diligence process, these analysts give you healthy pushback on your exit models, don’t fret; it’s likely that the real exit scenario is somewhere between what your CFO predicted and what your VC funds investors predicted.

Another interesting dynamic that occurs during Series D funding if an acquisition is the likely exit scenario is that your investor is likely to leverage their internal network to see how receptive potential competitors might be to acquiring your startup. To be as prepared as possible, you should have at least some prior relationships or references from potential acquirers that you can share with investors to signal that there is demand.

This is a reasonable approach for your investor. They can’t sell their equity in your startup unless there is a buyer for their equity, so remain calm as they try their best wrapping their head around who the buyers might be.

Other than that, your pitch, pitch materials, and data room will be similar to the ones you used in Series C, though your financial documents might have more strict accounting practices. A potential new entrant to your data room, if you’re in a market with low competitors, are preliminary reports on how being acquired by a larger company might be viewed by government regulators from the Federal Trade Commission (FTC) in the United States or other international competition authorities.

We urge you to check out our Series B guide for a deep refresher on growth-stage funding sources. Throughout the growth stage, the options you’ll be exploring are venture capital funds, cross-over funds, venture debt, and some forms of recurring revenue advancements.

For Series D, there is a unique funding source worth touching upon: large corporations that might be your potential acquirers in a couple of months. Corporate venture capital is traditionally invested in the earlier stages, but some larger companies like Alphabet, Amazon, and Meta sometimes take Series D positions as a pre-cursor to acquiring the company.

A recent example is Nest Labs, the startup that made smart home products. Nest had Google Ventures lead two of their growth-stage rounds before Alphabet ultimately acquired the company for $3.2B.

How Much Series D Money Should You Raise?

How much money to raise during Series D depends entirely on your startup’s needs. Different industries have different growth targets for going public or getting acquired.

Also, public market climates are often more turbulent to recessions or corrections, which can affect how public market investors evaluate your startup, removing your ability to successfully IPO for a few quarters. Other times, it’s just poor financial due diligence that can blow up an IPO. Look no further than the failed WeWork IPO to see what a poorly executed exit strategy looks like.

With that being said, since the goal of Series D funding and beyond is to get your organization ready for exit or an acquisition, look at how public markets or acquisitions markets are pricing companies like yours to figure out how much to raise. If the markets are in a recession, it might benefit you to stay private a little longer, so you have to manage your cash flows accordingly.

Sometimes public market investors will demand profitability for your sector, so a good rule of thumb is to raise enough money to sustain 24 months’ worth of operations until you’ve found a way to break even. Consult with your Series C investors, your board, mergers and acquisition brokers, and investment banks to get a better pulse on what’s the right situation for your startup. They see more deals than you do, so they’ll be able to give you insights on what the right metrics are to go public or get acquired and provide you with last resort options in case you need to continue raising Series E or beyond.

Like in Series C, a consideration to keep in mind while determining how much Series D money you should raise is the average valuations of seed to Series B startups in your space that might be worth acquiring to sweeten exit potential. The question to ask is how much cash you might need to acquire your largest upcoming competitor.

To give you some real numbers, at Failory, we studied 810 Series D rounds and triangulated that the average amount raised in a Series D round by US startups is $143,542,332, while it’s $138,657,101 for startups in the rest of the world.

Which Was the Largest Series D Round?

At the time of writing, the distinction for the largest Series D funding round goes to Lacework, the data-driven security platform for the cloud.

Lacework raised $1.3B in growth funding at a post-money valuation of $8.3B in November 2021 from a syndicate of investors led by existing investors like D1 Capital Partners and Tiger Global Management, and with participation from new investors including General Catalyst and Snowflake Ventures.

Lacework plans to continue to grow and stay private for the foreseeable future as they still have more market to penetrate with a 3x year-over-year revenue growth and a 3.5x year-over-year increase in new customers. With these funds, they’ll be able to extend their lead in the cloud security market by pursuing additional strategic acquisitions, like Soluble.

The All-In-One Newsletter for Startup Founders

Every week, I’ll send you the top 10 startup news and resources and an analysis of a failed and a hot company. Join +30,000 other startup founders!

The right framework for how long Series D funding should last you is forever or long enough to prepare you for an exit or another round of funding.

Plan for funds to last you long enough to:

- Obtain enough market share in all the markets you’re in so you can be profitable but keep growing at a steady rate using the profits without having to raise more money and while remaining a private company.

- Explore an exit strategy with your investment bankers or other underwriters.

- Raise a Series E.

Growth-stage money is scarce. Don’t risk having to do a Series E down round, as this will dilute you and all your employees significantly, lowering morale.

Since you have so many costs and growth targets are now slower to hit, this usually translates to 24-36 months’ worth of operating cash flow (burn rate) until you may run out of money (runway). If you are default alive and making more revenue than you’re spending, you’re usually in a flexible position to choose your destiny with different exit opportunities beyond unlocked.

3 Examples of Series D financing

A textbook example of Series D financing is TiFin, which aims to match investors with investments in the wealth and asset management industries. TiFIn announced in May that it had raised a $109 million Series D round, less than a year after its Series C last October. The round brings the company’s valuation to $842 million, nearly doubling the $447 million it was valued at after its Series C. The round was led by Motive Partners, who joined as new investors with participation from existing investors, including private markets investment firm Hamilton Lane, J.P. Morgan, and Morningstar.

Kavak is another interesting case study. It’s a Mexican startup that has disrupted the used car market in Mexico and Argentina. The team raised a Series D of $485 million, which valued the company at $4 billion in April 2021. According to the CEO, the company plans to use Series D to build out the Brazilian market and beyond.

On another extreme, Devoted Health, the InsureTech scaleup offering Tech-enabled Medicare Advantage, closed a $1.5B Series D financing round. Devoted Health rode the high cost of healthcare in the US to term sheets from previous investors like Andreessen Horowitz and NextView Ventures, along with new investors like ICONIQ Growth and General Catalyst.

Wrapping Up

We covered what Series D financing is, how to determine when and how much to raise, how long it should last, and some funding sources.

The Failory team is beyond excited that you’re so close to exiting your startup. We hope to see your startup ringing the opening bell on the New York Stock Exchange or NASDAQ, and if you have the room, we shamelessly would love to be invited.