Sheet

1,000 VC Firms

Information about the countries, cities, stages, and industries they invest in, as well as their contact details.

Get the Sheet for $50

This article will dive deeper into how to raise a Series B round to take your significantly battle-tested product or service and efficient organization to unicorn status.

We’ll cover what Series B financing is, when and how much to raise, how long it should last, and some funding sources.

What is Series B Financing?

Series B financing is an investment into your private startup after you raise a Series A. It’s the first of what are commonly referred to as late-stage rounds.

Series B financing works very similarly to Series A. You pitch multiple investors on your startup; they perform their diligence; if they have high conviction, you receive a term sheet which you can negotiate; you get the money wired to your company’s account. We’ll add more color to the subtle differences in a later section.

Completing this round will allow you to step your foot on the growth pedal going from a startup to an actual corporation. You’ll have abundant cash to expand your team and penetrate new regional or even international markets.

Typically, Series B funds are used for:

- Leveraging the internal culture and management processes to grow your team in all directions.

- Use your repeatable sales and marketing playbooks to penetrate the market and enter new ones.

- Slightly iterate on your product to retain your customers and add any new features that different markets might need.

By this stage, your startup probably has real metrics and historical numbers, which you should use as a reference during Series B fundraising. Your product or growth projections are no longer based on speculation – you now know how deploying Series B money will translate into potential outputs.

When to Raise Series B?

Late-stage investors are more sensitive to macroeconomics conditions and are significantly pickier than early-stage investors, so access to capital isn’t always guaranteed. This means rounds usually take longer to raise because of the level of historical data that they process during diligence.

With this in mind, you should start raising your Series B 10-12 months before you’ve run out of money. This will give you, your team, and your board enough time to pitch to your existing and new investors that your startup’s traction and trajectory are worthy of a Series B round.

Some of your early-stage investors might not have enough cash in their funds to participate in your Series B. Yet, you can ask them to introduce you to some late-stage investors.

By this moment of your startup’s life, you should be well-versed in the art of monthly investor updates. Use these updates as assets to expose potential new investors to the fundamentals of your startup.

At this stage, your startup is no longer a small group of engineers from the same schools or social networks. The employees that joined you during Series A and those that will be joining you while you deploy your Series B funds expect more financial stability. Going bankrupt because you mismanaged your fundraising process should not be an option. You owe all who believe in you to be responsible for your fundraising timeline.

How is Series B Different From Series A?

From a distance, the differences between Series A vs. Series B funding can be blurry. To get a clearer picture, you need to zoom in on the specific traction of the startups raising Series B rounds.

Series B startups usually have well-oiled company operations, strong signals of product-market-fit, and good revenue and cash-flow management. Series A funds are used to reinforce the strong foundation built in pre-seed and seed, while Series B funds are primarily used to scale the business above the foundations.

Usually, Series B startups have higher revenue than Series A startups, and consequently, their valuations will be significantly higher, but of course, this looks different across industries. Series A startups raise anywhere from $2-$20M with lots of variations in valuation, while the median Series B startup raises $50M.

How is Series B Different From Series C?

Series B and Series C differences are even blurrier as they are both late-stage rounds. Simply put, Series B startups are less mature regarding revenue and international market penetration than Series C startups.

It’s entirely possible for your startup not to need more funding after Series B if you’re profitable and your revenue alone is enough to keep growing.

However, around mid-way through deploying your Series B, you’ll likely realize that to continue growing, you’ll need substantially more money to create new products, acquire innovative companies, or penetrate international markets further.

For Series C, you’ll have more cash in the bank, so you’ll look outwards for finding new products or teams, acquire more startups with innovative products and plug them into your existing R&D workflows to continue to grow.

At a superficial level, the check size of the Series C rounds is typically double that of Series B rounds.

Here’s our guide to Series C fundraising.

How Does Series B Funding Work?

Series B works very similarly to other priced equity fundraising rounds that we’ve covered in the past. You pitch multiple investors, you go through their due-diligence process, and if they decide to invest, you’ll negotiate terms.

Many investors, like venture capital firms, only focus on late-stage rounds like Series B onwards, and they have different investment processes than the early-stage VC funds you’ve interacted with in your previous rounds.

These growth-stage investors rely heavily on your startup’s internal metrics to decide whether to invest in your startup or not. Therefore, your pitch, pitch materials, and data room must include the metrics investors analyze to get a conviction.

Essential metrics that Series B investors are keen to learn about include monthly growth, sales efficiency, and customer retention rates. Furthermore, operational metrics like costs for productivity, salary pay for different organizational departments, and hiring and retention numbers are frequently also analyzed by investors.

Keep in mind that the macroeconomic climate can affect how investors perceive metrics. For a deeper dive on metrics, we recommend this article from Initialized, a prominent growth-stage venture capital firm.

As a founder, if you’ve scaled to Series B, you’ve succeeded at building something people want and successfully got it into people’s hands at a scale that gives you the option of becoming self-sustainable. You can calibrate your startup so that current and future profits can cover current and future costs while the startup continues to grow.

This is a viable option if you’re operating in a space with few competitors and currently have most of the market share. In the long run, you’ll dilute the founding team and your early employees less by bootstrapping Series B onwards.

However, if you’re in a hypercompetitive environment with well-funded competitors, it might be in your best interest to have an equal sized war-chest to appropriately maneuver yourself in the battlefield that is the market.

An example of this would be the hot competition occurring in the ride-sharing service market between Uber & Lyft. Even though Lyft was first to market over Uber by over two years, it was Uber’s ability to raise more money and deploy it more effectively towards growth that helped it secure its position as the market leader. Just imagine how much worse it would have been for Lyft if they decided to bootstrap after reaching profitability while Uber continued to raise large growth rounds from VCs.

It’s up to you to determine if you’re operating in an environment where you can afford to bootstrap through the rest of your lifecycle. You can always bootstrap, and then, if a well-funded competitor enters your space, reevaluate your funding strategy and approach other investors.

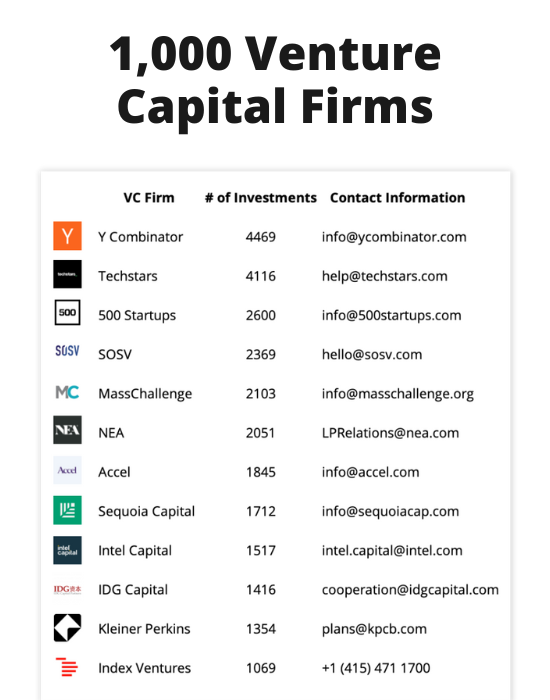

2) Venture Capital Firms

Growth-stage venture capital firms are the most common funding source for late-stage founders raising Series Bs. This makes sense because many VCs firms have seasoned operators or other in-house resources that are created to support you throughout your biggest growth-stage challenges.

For example, firms might have previous founders as partners who have navigated the same waters of international expansion for your specific sector that you’re trying to go through. Also, since hiring is always challenging, VC firms might have talent in their network that can help with tricky matters like regulatory or go-to-market challenges in new markets like Asia-Pacific, LatAm, or Europe.

Some famous growth-stage venture capital firms are TPG growth, General Atlantic, and Bain Capital. Many blue-chip early-stage venture capital firms like Sequoia, A16z, Benchmark, and Norwest Ventures have funds focused purely on growth-stage startups so they can continue to invest in startups they’ve invested in early through their lifecycles.

3) Cross-Over Funds

Cross-over funds are a great funding source for Series B founders that have been getting a lot of hype in the media. As their name implies, cross-over investors are those that invest in multiple stages of private investment markets, from Series B through pre-IPO and even cross-over into post-IPO positions. They are usually hedge funds, private equity firms, investment banks, and family offices that elbow their way into venture capital and startups.

Cross-over funds usually don’t provide the value-added services, like operational expertise or in-house resources that VC firms bring with their checks. However, they’re able to compete with VCs for allocations in Series B and other growth-stage rounds because they write checks faster and at higher valuations.

For repeat founders that don’t need to have their hands held, a low-maintenance hands-off investor that doesn’t require a board seat is a feature, not a bug. So if you’re looking to maximize your startup’s valuation or if you’re a repeat founder who has been there before, cross-over funds might be the perfect funding source for you.

Some famous cross-over investors are the hedge funds Tiger Global, Coatue Management, and Dragoneer investments. Others include banks like Silicon Valley Bank, Goldman Sachs, and Morgan Stanley.

4) Venture Debt

Debt offered to privately held startups has consistently been a viable funding source for Series B and other growth stages.

The loans have traditionally been offered by banks like Silicon Valley Bank and FirstRepublicans. Rarely, in the case of emergency bridge rounds, your previous VC funds might also provide you with regular or convertible debt.

Debt is not a replacement for equity, meaning it’s tough to scale a startup to a billion dollars valuation without a single equity round. In fact, venture debt lenders often use equity rounds from other investors as a primary form of validation for underwriting startups. As a result, if you want to raise venture debt to fill your Series B, you’ll likely need to get an equity term sheet from other investors first.

At a high level, debt works best when you need to finance a predictable future with little uncertainty, such as when there’s a predictable return on debt capital. Equity works better than debt when there is uncertainty around the future of how deploying the debt capital will generate revenue, like when you’re building a new product and exploring monetization strategies.

The two main terms while negotiating venture debt with lenders are the size of debt and interest rates. These can vary greatly depending on the lender and the macroeconomic climate. We recommend this article from a16z, a premier venture capital firm, for a more in-depth guide to venture debt.

5) Recurring Revenue Advances

These days, various innovative fin-tech startups are creating interesting recurring revenue advance debt products that might be worth exploring to see if they satisfy your needs.

As a caveat, this only works if your business model involves recurring payments with little churn. The broader concept for recurring revenue advances is to get capital upfront based on existing revenue so you can grow.

If your enterprise software company has legally binding contracts for $5 million in MRR, the company can sell 5x those future monthly cash flows for $22.5 million in cash today, while the whole $25 million of future cash flows are paid to the investor/lender over time. Different providers like Capchase, Pipe, and Stripe have variations on this.

The All-In-One Newsletter for Startup Founders

Every week, I’ll send you the top 10 startup news and resources and an analysis of a failed and a hot company. Join +30,000 other startup founders!

How much money to raise depends entirely on your startup’s needs, industry focus, and the macroeconomic climate for late-stage investing.

Yet, a framework for Series B’s is to raise enough money to fund/meet your revenue growth milestones to raise a Series C or become cash-flow positive so you can bootstrap growth for the rest of your lifecycle. To get more color on what’s best for you, collaboratively discuss these growth milestones with your Series B investors to guarantee a future Series C check. These same investors will likely be the ones involved in your C round.

For specific industries like deep-tech or biotech, it’s possible that you still won’t have meaningful revenue or product-market fit at a Series B stage. For a traditional enterprise or consumer SaaS startup, a growth rate in revenue in the range of 2x year-over-year (5% month-over-month) to 3x year-over-year (10% month-over-month) will be enough to secure Series C funding next round.

We highly recommend brainstorming how to best deploy Series B funding to get the required growth with the rest of your management team. In Series B, you’ll usually have 50-150 employees you brought onboard because they are specialists at building new products or penetrating new international markets.

To give you some data, at Failory, we studied 3,313 Series B rounds and discovered that the average amount raised in a Series B round by US startups is $49,940,374, while it’s $49,759,691 for startups in the rest of the world.

Which Was the Largest Series B Round?

The size of Series B funding rounds can be mindblowing and entertaining to learn about.

At the time of writing, the award for the largest Series B funding round goes to CommonWealth Fusion. This Boston-based energy company is building the first commercial fusion power plant that will help power the world in an environmentally friendly manner.

CommonWealth raised a star sized (pun-intended) $1.8B Series B round in December 2021 from a syndicate of investors that Tiger Global Management led, with the participation of new investors like Bill Gates, Coatue, and Google, as well as their previous investors.

Pragmatically, your startup isn’t building in a space where you’re trying to recreate the sun’s power on planet earth. So don’t expect to raise amounts anywhere near that for your Series B round, especially if you’re building a software business.

How Long Should Series B Funding Last?

How long Series B funding should last depends on many factors but is weighted heavily on R&D costs and the cost to penetrate international markets.

The general rule of thumb is that it should last you as long as you and your team need to either:

- Hit the product and revenue milestones that future Series C investors expect for them to write another check to meet your future growth ambitions.

- Obtain enough market share in all the markets you’re in so you can be profitable but keep growing at a steady rate using the profits without raising more money (bootstrapping).

Since you have so many people on payroll, and growth slows down, this usually translates to 18-27 months worth of operating cash flow (burn rate) until you may run out of money (runway). If you achieve profitability, it’s possible that you can extend your runway without running out of money.

3 Examples of Series B Financing

A textbook example of Series B financing is Real, a digital mental health tool that helps people understand themselves and their needs. They raised an oversubscribed $37M Series B led by Owl Ventures, with participation from former Cityblock CEO Iyah Romm and Chief Health Officer Dr. Sylvia Romm, as well as previous investors, including Lightspeed Venture Partners, Female Founders Fund, Forerunner Ventures, and BBG Ventures.

Hex is another interesting case study. Hex sells its data science collaboration platform to other enterprises whose data teams want higher productivity. The team raised a $52M Series B in March 2022. According to the TechCrunch report, the startup has almost doubled the number of employees since October, from 18 to 35, with plans to roughly double again in the next year while deploying its Series B.

On another extreme, FTX, the Antigua-based startup that hosts a cryptocurrency exchange where retail and institutional investors can trade cryptocurrencies and non-fungible tokens, raised a $900M Series B financing round. FTX leveraged the crypto hype to a term sheet at an $18B post-money valuation from over 60 investors, including Sequoia Capital, SoftBank, and Insight Partners.

Wrapping Up

We covered what Series B financing is, how to determine when and how much to raise, how long it should last, and some funding sources.

You should now feel confident with the overall Series B process. We wish you the best of luck with your journey.