Sheet

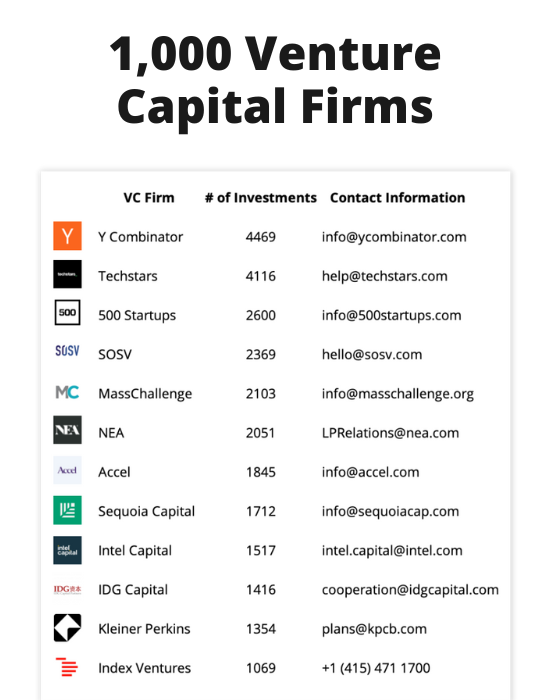

1,000 VC Firms

Information about the countries, cities, stages and industries they invest in, as well as their contact details.

Get the Sheet for $50

If you’ve made it this far in the startup journey, you have an important battle-tested product or service, and you’ve built an efficient organization that knows how to launch products in a variety of markets.

To raise a Series C, you need to leverage this success to persuade investors that there is more room to grow.

In this article, we’ll dive into what Series C financing is, when and how much to raise, how long it should last, and some funding sources.

What is Series C financing?

Series C financing is the next stage of growth investment in your company after you’ve raised a Series B.

The fundraising dance is one you’re already familiar with. You will pitch to various growth-stage investors on your startup’s potential to become a unicorn in the near future. Investors will run their own internal due diligence process to evaluate your company. If there is a potential fit, they will send you a term sheet which can be negotiated. You’ll then receive a wire for the amount in your checking account and return to work on creating a unicorn.

This phase should allow you to manage dizzying overgrowth and ignite new sources of growth. You’ll have a deep war chest to continue expanding your team, expanding into more markets on your way to global and regional market dominance, and perhaps acquiring smaller startups so you can offer new products or services.

Typically, Series C funds are used to:

- Grow your team by acquiring promising engineering teams from small startups with compelling products or services.

- Integrating new products or services into your repeatable sales and marketing funnels to unlock more revenue.

- Preparing financial scenarios and internal hypotheses to optimize exit scenarios, either from a large corporation or through an acquisition through the public markets.

When to raise Series C?

We recommend that you start raising your Series C 12-14 months before the funds from your Series B run out. This will give you, your team and your board ample time to pitch and showcase your existing and new investors. The startup is on target to meet your revenue and growth goals. Going bankrupt due to poor cash-flow planning will leave you and your team with deep regret when you succeed in building an innovative product.

It is not unusual for startups to have Series C term sheets from their previous Series B investors prior to fundraising. This is called a “pre-empting funding offering,” and they occur in Series C and beyond because of the predictability of revenue in some industries, such as enterprise SaaS.

How does Series C funding work?

The mechanics behind a Series C are fairly similar to other value equity fundraising rounds we’ve covered in other guides: You’ll pitch to a number of investors, you’ll go through their due-diligence process, and if they agree to invest, decide, you’ll negotiate the terms.

To raise a Series C, it’s important to have clear data storytelling about how successful you’ve been and why there’s still more room to grow. In turn, the due diligence process relies on development-stage investors being very data-centric. Investors become recognition machines: They care more about internal metrics of traction than the vision-focused pitches you delivered in earlier rounds. As we mentioned earlier, this dynamic of data diligence lead to a unique fundraising phenomenon for Series C and beyond: the pre-emptive funding offering.

Your Series B investors have access to information on your scaleup. Your investors are probably refreshing the same internal data dashboards that you are and analysts are speculating on your growth trajectory.

These companies are patiently waiting for you to find an inside edge on your next round and will strike when the time is right. They often have an ownership target in the startups they invest in. Their goal is to get as much equity as you are willing to pay.

This is why in practice, your Series B investor will show up at your office and hand you a term sheet before you start raising your Series C.

They’ll say something like this: “We believe in you so much that we’re okay with only being 75% towards your revenue goals. We want you to avoid going through a lengthy fundraising process. Here’s an evaluation But one we think is worth checking out. We recommend you take it so you can continue scaling rapidly.”

As a founder, fundraising is a distraction and a drain of energy. However, it is in your and your employee’s best interest to minimize dilution, so at the very least, you should use that pre-emptive term sheet to test the waters with other investors, to see if As for whether the valuation you are getting is fair- market value.

Beyond that, your pitch, pitch content, and data room will be identical to what you used in Series B. Essential metrics used in Series C fundraising are revenue growth, sales efficiency, customer retention rates, and other operational culture metrics such as cost to productivity, salary payments for various organizational departments, and recruitment and retention.

Your sources of Series C funding are more or less the same as the growth-stage options you had in Series B. you will explore venture capital funds, cross-over funds, venture debt, and some form of recurring revenue advancement.

We highly recommend checking out Failory’s Series B Guide To find out the specifics between Series C funding sources.

How Much Series C Money Should You Raise?

How much money to raise depends entirely on the needs of your startup. Different industries have different growth burn rates. In addition, growth-stage checks are not always guaranteed for startups because recessions or reforms can affect how growth-stage investors fund, so raising capital is always a scarce resource.

A good broad framework is to raise enough money to sustain 24 months of operations or break even. Consult with your Series B investors or your board to get a better pulse on the right positioning for your startup. They’ve seen more deals than you, so they’ll also be able to give you insight on what healthy growth metrics are to raise a Series D if necessary.

have an average evaluation of something to consider pre seed To series a Startups in your space that may be worth acquiring. Series C is when it becomes viable to earn your way to more growth. So it’s a good idea to ask yourself how much cash you’d need to acquire the top two most promising startups in your sector if you had to pay 50% of their current valuation in cash.

Another major use of Series C funds is recruitment and R&D. At this point, equity is considered less valuable to potential employees, so you’re better off offering competitive pay rates. Do a bottom-up analysis of how many more team members you need to hire to meet your revenue goals and add a healthy buffer to that amount.

In Fallory, we studied 1,671 Series C rounds. We found that the average amount raised by US startups in a Series C round is $87,983,683, compared to $88,590,415 for startups in the rest of the world.

Which was the biggest Series C round?

At the time of writing, the distinction of largest Series C funding round goes to China-based biotech company Abogen Biosciences, which was making the first mRNA COVID-19 vaccine in China.

Abogen raised $1B in August 2021 from a syndicate of investors, with approximately 20 new and existing investors providing support.

In fact, your startup is not trying to build a solution to the deadliest virus pandemic in recent decades. So, don’t expect your Series C round to raise the amount anywhere, especially if you’re building a software business.

How long will the Series C funding last?

The right mindset for how long Series C funding should last is forever or enough to get you more money.

The general rule of thumb is that it should last as long as you and your team either need:

- Hit the product and revenue milestones that future Series D investors or public market investors expect them to write you a check for.

- Be adapted to interact with potential acquaintances if there is a right exit.

- Gain sufficient market share in all markets in which you can be profitable but grow at a steady rate without raising much money and using profits as a private company.

Growth-stage money is scarce. Startups are expensive to acquire and successfully integrating them into your distribution channels is equally difficult.

Since you have a lot of costs and growth targets are now slow to hit, this usually equates to 24-36 months of operating cash flow (burn rate) until you can run out of money (runway) . If you are surviving the default and are earning more revenue than you are spending, you are generally in a flexible position to choose your destiny.

All-in-one newsletter for startup founders

Every week, I’ll send you top 10 startup news and resources and analysis of a failed and a hot company. Join +30,000 other startup founders!

A textbook example of Series C financing is Monte Carlo. This end-to-end data observability platform helps enterprises understand and trust their data so that they can make smarter decisions. They oversubscribed a $101M Series C round led by ICONIQ Growth led by Salesforce Ventures and with participation from existing investors Accel, GGV Capital, and Redpoint Ventures.

Eden Health is another interesting case study on the smaller side. Eden is a health concierge provider that provides health services such as primary care, behavioral health services, and benefits navigation to employers and commercial real estate building landlords. The team raised $60M Series C in February 2021. As FierceBiotech reports, the company plans to use the Series C funding to grow the number of brick-and-mortar medical offices in cities such as Boston, Chicago, Houston, and Los Angeles. Angeles.

At another extreme, Gorilla, the Berlin-based scaleup offering on-demand grocery delivery and dark store operator, closed a $1B Series C financing round. Gorillas puts food delivery promotion on term-sheet at $3.1B post-money valuation from previous investors like Coatue Management, DST Global, and Tencent, along with new investors like G Squared, Alanda Capital, and Thrive Capital.

wrapping up

There you have it — we’ve covered what Series C financing is, how to determine when and how much to raise, and how long it should last.

At this point, you should feel like a fundraising pro. The Failory team is very excited that you are so close to making a unicorn.