Sheet

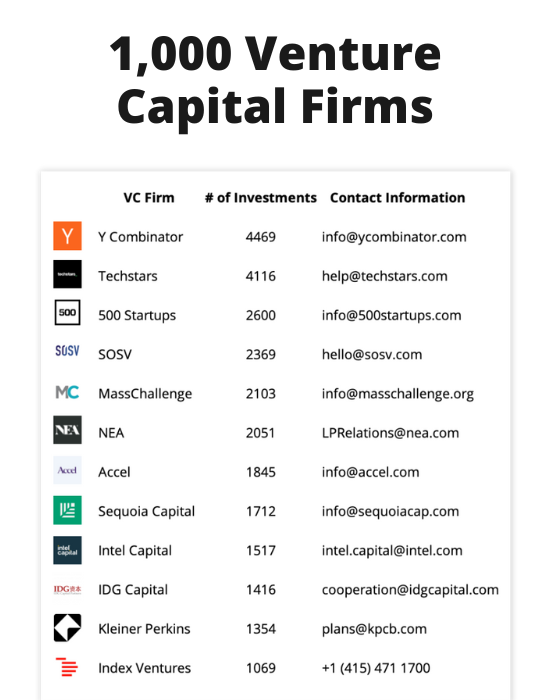

1,000 VC Firms

Information about the countries, cities, stages and industries they invest in, as well as their contact details.

Get the Sheet for $50

An investment memo is a brief document used by startups to present their company to potential investors.

Investment memos present your company’s strategic vision, business strategies, rationale and expectations for the investment. They are a great tool to help you raise capital from venture capital investors.

Venture capital investors use investment memos as supporting documents in their investment decisions. This guiding document helps them to ascertain whether the investment opportunity is worth pursuing.

In this article, we will cover the following:

- What is “Investment Memorandum”.

- Why is it important to have one?

- Its core elements include the differences between an investment memo and a pitch deck.

- An investment memo template that you can customize to suit your startup.

- Various examples of investment memos from well-known companies.

What is an Investment Memo?

y combinator An investment memorandum describes “a clear and concise expression of the key components of your company and the rationale for investing in it.”

As a startup founder, creating this memo helps clarify why investors should put their money into your company. A clear and well-written investment memo is important so that you can get the best deal for your startup.

Why Startups Need Investment Memo?

As we discussed earlier, the investment memo is a powerful tool for communication between a startup and a venture capital firm during the investment process. Investment memos are used to:

- View the startup story and business plan in a clear format.

- Outline the main reasons why investors should invest.

- Align your business team and potential venture partners with what matters most to your company and product.

Investment memos are often overlooked because those involved feel that the existing pitch deck serves the same purpose. However, this is not always the case.

investment memo vs pitch deck

A pitch deck A presentation is the means by which you share an overview of your business goals, product roadmap, potential services and direction of growth.

An investment memo has similar elements but is written in document form and presented more formally than a pitch deck.

A pitch deck will create your picture in front of investors, but an investment memo is a more detailed version of why they should invest in your company.

So, although they use similar information, the difference is in how you write down the key elements of your company and present it to an investor.

Some advantages of an investment memo over a traditional pitch deck are:

- An investment memo is a document with a clear structure and information, whereas a pitch deck sometimes consists of overly visual slides and lacks context.

- A structured document makes the investment memo easy to read by investors. A slide-based presentation can sometimes lack narrative.

- An investment memo is ready to be shared with other third-party sources, whereas a pitch deck does not convey the whole story.

What to Include in an Investment Memo

Here are the main elements to include in an investment memo for startups seeking investment:

1. Introduction

This introductory section should include the reasons your company exists and the primary purpose of your business. Write it as a clear and concise overview; You can think about the following:

- What does your business do?

- What are the current solutions available in the market?

- How will your solution generate revenue and shape the market?

2) problem

The problem section talks about the pain points of your core audience that you are trying to address and what the environment will look like once you solve it. Describe things like:

- What problems are you trying to solve?

- How do you plan to address some of these problems?

This section is relatively straightforward. You’ll need to cover the key elements of your product, business model, and your target market.

- What is your business model?

- Describe your product roadmap.

- How do you ensure product-market fit?

4) Market size

After you’ve covered the main problems and how your solution addresses them, it’s time to put things into perspective for your potential investor. Describe the size of the market, your primary customers and the opportunity to grow your business.

- What is your position in the competitive landscape?

- Describe your customers.

- Define the size of the market opportunity you are creating for them. How big is it?

5) Competition

After mapping out the market, it’s time to move on to the competitive solutions available. You can explain how your solution is better than theirs and what unique selling advantages you have that set you apart from your competition.

- Who are your competitors?

- How is your solution different?

6) Development and Distribution

This is the part where things get more oriented towards your plan. Include your go-to-market strategy, the key actions you’ll use with investment funding, and the results you expect by the end of the campaigns.

- What are the elements of growth that will empower your company?

- What is your go-to-market plan?

- How much have you raised before?

- How much are you looking to raise now?

- How will their funding round solve your current issues?

7) metrics

Investors are looking for actionable elements. It is essential to describe your current revenue drivers and growth strategies. Try to include charts in this section and highlight the following:

- Your main revenue driver.

- Business metrics to show market traction.

- Product metrics (churn, ACV, rake, etc.)

8) Team

Every plan is brought to life by an execution team, so talk about your team in the investment memo. Describe your core team members for going to market, who they are, why they are the right candidates for those roles, and what makes them unique. Additionally, state your plans to grow the team over time and how investing in this area will contribute.

- Who are you?

- Who are the members of your team?

- What are their abilities?

- What makes your team special?

- How do you plan to grow your team over time?

investment memorandum template

It is important to think about investment memos if you are looking to get some funding.

We’ve got angel investor Steve Schlafman’s investment memo template idea that you can use to help you get started.

This template includes the basic elements of an investment memo that will help you outline the information investors look for most about a company.

You can download investment memorandum template Here,

6 investment memo examples

Raising money for early stage startups has a creative component as the founders get to share their startup story with investors. A story that is told through clear information as well as great supporting material is more likely to be successful.

Here is a list of investment memorandum examples venture capital firms Sharing his insights on various investment projects around the world.

shopify venture capital investment memo example

Shopify is considered one of the most successful investment deals of Bessemer Venture’s portfolio. His investment memo was published nearly 10 years after the deal was done.

This investment memo includes an overview of the company’s objective to attract the $7M Series A funding round. It provides an overview of their market opportunity, including details on their customers and pricing strategies.

The information is also supported by financial reports, customer acquisition, retention metrics and an instant view of the competitive landscape.

Bessemer’s view of the deal states that the results of his analysis were 2 times higher than he expected.

Read the full Shopify investment memo Here,

All-in-one newsletter for startup founders

Every week, I’ll send you top 10 startup news and resources and analysis of a failed and a hot company. Join +30,000 other startup founders!

DoorDash has been an investment of Sequoia since 2012, where they led a $17.3M Series A round. The investment memo was only published in 2020 when DoorDash celebrated its IPO by Alfred Lin, a partner at Sequoia Capital and one of the lead investors in the deal.

The investment memo contains information about who DoorDash is and what they want to build. It captured the founder’s story, customer passion, and the company’s mission in supporting restaurants and local businesses.

Read DoorDash’s full investment memo Here,

twitch venture capital investment memo example

Bessemer Venture Partners invested $13M in Twitch.TV in a Series B round back in 2012.

The document goes through key moments of the company’s growth and exit, such as the official acquisition of Justin TV from Twitch and Amazon.

In this investment memo, Ethan Kurzweil, partner at Bessemer Venture Partners and one of the lead investors, highlights that one of the main reasons behind the investment was the team. Bessemer liked Twitch’s founders, their passion for delivering consistently, and their solid focus on what they wanted.

Twitch’s investment memo also goes through the company’s value proposition, key insights about the market they were participating in, and impressive metrics that highlight good product adoption and usage.

Read the full Twitch investment memo Here,

youtube venture capital investment memo example

Sequoia Capital made an early investment in YouTube, bringing in an initial $1M seed round, followed by a further $4M in Series A. The investment memo was published as a confidential document in 2005, but only released publicly in 2010.

The document was made public by Roelof Botha, an investor in Sequoia. trial between Viacom and YouTube, during which he had to disclose the document as part of his testimony.

YouTube’s investment memorandum and the data inside confirm why Sequoia believes in the power of YouTube.

The document highlights the company’s main competitors, advantages and disadvantages, and market insights that have made its position unique. YouTube’s investment memo also goes through the product development elements, sales, and marketing efforts the company has achieved.

Read the full YouTube investment memo Here,

airbase venture capital investment memo example

Airbase raises a Series B amounting to a total of $60M to grow its spend management platform. The investment was led by Silicon Valley venture capital fund Menlo Ventures.

The investment was also joined by Craft Ventures and existing investors such as Bain Capital Ventures, First Round Capital, Quiet Capital, Webb Investment Network and BoxGroup.

This is the first example featuring an investment memo from a founder rather than an investor. Thejo Kote, CEO of Airbase, explains that they used this investment memorandum to better tell the company’s story and gain more credibility in front of investors.

Read the full Airbase Investment Memo Here,

ripple venture capital investment memo example

Kleiner Perkins led a $45M Series A funding round in Ripple, an employee management platform, in April 2019. In an investment memo published on their blog, the company’s founders share how they managed to raise this round without a traditional pitch deck.

Ripple’s investment memo is relatively short, just 11 pages that go through a brief overview of the company. This includes the strategy behind building the platform, a good product overview, who the main competitors are in the market, and what they have managed to achieve so far.

Read the full Ripple investment memo Here,