Sheet

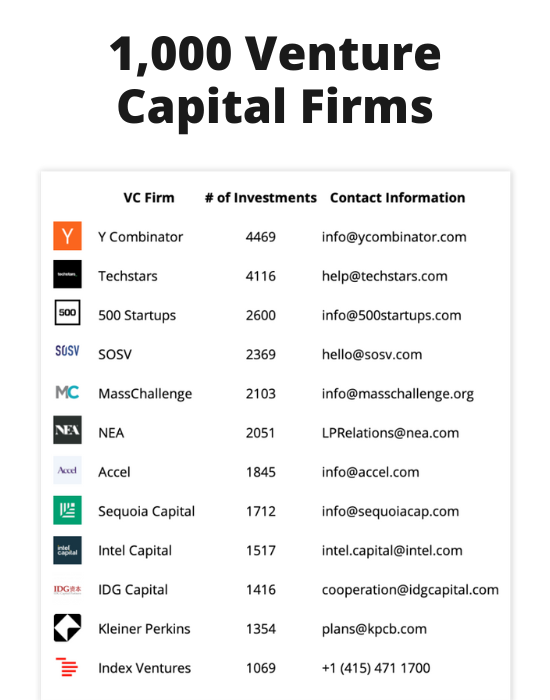

1,000 VC Firms

Information about the countries, cities, stages and industries they invest in, as well as their contact details.

Get the Sheet for $50

So, you’ve created a product, you’ve got your first customers and you’re ready to raise money.

You don’t have a VC knocking on your door but you’re wondering how they work so you want to learn more about raising money.

This post is for you.

What is Venture Capital?

Venture capital is a form of private equity financing that is typically invested in early-stage startups and small businesses that have long-term growth potential.

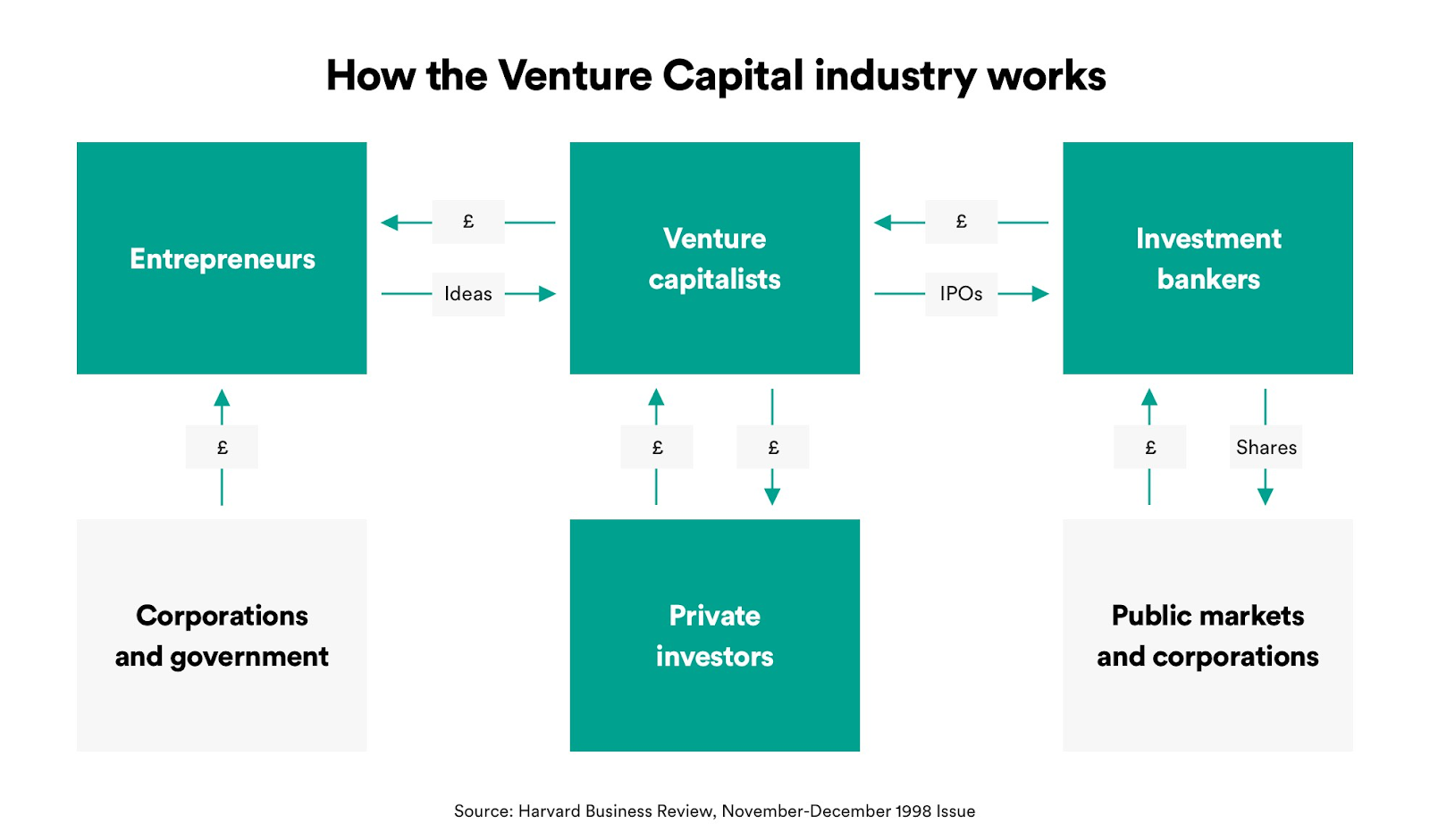

where does this capital usually come from venture capital firms, wealthy individual investors and investment banks. Venture capital firms, which manage significant venture capital funds, are the most common source of this type of private equity.

There is usually a high-risk, high-reward potential associated with venture capital, and venture capitalists know that not every project they back will give them a return on their investment.

However, the projects that do succeed are often so lucrative that the higher returns more than make up for the losses in the long run.

Since venture capitalists are heavily dependent on their investments, investors often participate in decision making and provide professional guidance to the companies they back.

In fact, many VC investors are themselves former entrepreneurs or industry experts. They often support projects in areas in which they have experience, so they can better guide them to success. As a founder, this is one of Pros of Raising VC,

How does Venture Capital work?

Venture capital is often given to individual entrepreneurs, co-founders, and early-stage startups as a way to continue to develop their products and kickstart growth.

It can be given to companies at different stages of their development. Many startups receive venture capital funding years after they are established, until they are acquired or go public.

To obtain venture capital, a startup’s founders must pitch their product idea to potential investors and convince them that it has high potential for growth and profit.

While this used to be a somewhat informal process, the venture capital industry has evolved so much over the past few decades that most VC firms now have a formal application process for anyone who wants to pitch them an idea for funding.

When VC investors look at potential investments, they analyze the business idea and plan. If they think it has a high potential for success, they do due diligence on the business model, the product, the co-founders, and everything else about the company.

Let’s say a pitch is successful and investors want to give a startup venture capital. In that case, they will offer funding to the startup’s founders in exchange for a certain percentage of equity in their company.

The ultimate goal of venture capitalists is to sell their equity in the companies in which they invest, usually when they go public or are acquired, in exchange for sizable returns.

As mentioned earlier, venture capital funding can be given to companies at different stages of their development.

The stages of VC funding are generally divided into three categories: seed round funding, early-stage funding, and late-stage funding.

seed funding

seed round funding VC is the first round of funding. During this type of round, VC firms typically offer brand-new startups a relatively small amount of money to help them work on their business plans and create an MVP if they don’t already have one.

early stage funding

The early stage funding is divided into three different funding rounds: series a, bAnd C, These funding rounds are what startups use to scale their early growth and generate revenue after an MVP and some traction.

Investors usually offer a lot more during early stage funding as compared to seed round funding.

late stage funding

Late-stage funding is divided into three funding rounds: Labeled series dSeries E, and Series F. Startups typically receive this type of venture capital funding when they are already generating revenue and need more funds to continue expanding their operations.

Companies seeking late-stage venture capital do not need to be profitable yet. Nevertheless, they should have a very positive outlook and the potential to be profitable in the near future.

All-in-one newsletter for startup founders

Every week, I’ll send you top 10 startup news and resources and analysis of a failed and a hot company. Join +30,000 other startup founders!

Venture capital is a type of private equity. The biggest difference between venture capital and private equity in a broad sense is that venture capital always invests in startups and early stage companies. Conversely, private equity can also be invested in established enterprises.

Non-venture capitalist private equity investors prefer to seek out established companies that are in financial trouble, and usually seek to acquire a majority stake in the companies they invest in.

Since they often hold more than 50% equity in companies, non-VC private equity investors also take a more active approach to managing and operating the companies in their portfolios.

On the other hand, since venture capitalists typically do not own a majority stake in their portfolio companies, they provide some guidance to management but usually do not play a large role in day-to-day operations.

That being said, at the end of the day, private equity and venture capital investors share the same goal: to increase the value of the companies they invest in and to sell their stakes at a profit.

questions to ask

What is Venture Capital?

Venture capital is a type of private equity funding provided to venture capital firms or startups and early stage companies with high growth potential.

How does Venture Capital work?

Venture capitalists invest capital in a company in exchange for equity. They usually hold a minority stake and have limited involvement in the management of the company.