Sheet

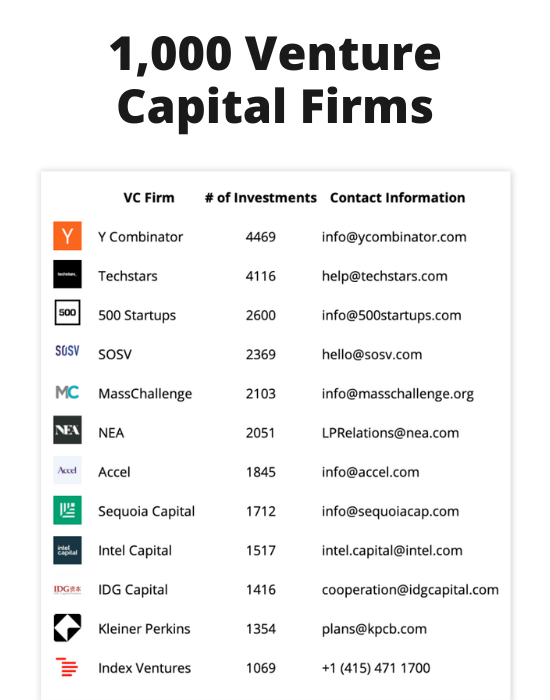

1,000 VC Firms

Information about the countries, cities, stages and industries they invest in, as well as their contact details.

Get the Sheet for $50

It’s always a big day when a startup enters the world of unicorns. After years of long nights slinging code and hundreds of millions of dollars in venture capital, a billion-dollar valuation validates your business model and signals that you’re ready to break out into the future.

This was until unicorns became common. According to Crunchbase, 400 startups join unicorn in 2021, raising the total number to just under a thousand. those are impressive figures because they were just down 39 startups are valued at $1 billion barely 10 years ago.

But as these unicorns grow in number, they evolve into finer, more majestic animals: the hectocorns, which are worth $100 billion.

In this article, we’ll dive deeper into the world of hectocorns, examining:

- what are they

- Which was the first hectocorne.

- How many hectocorns currently exist?

- What to expect from Hectocorn in 2023.

What is a hectocorne?

Unicorns are startups valued at $1 billion, while decacorns are startups with a valuation of at least $10 billion. The most elusive of them are hectocorns: privately held startups valued at $100 billion.

The word hectocorne is derived from the Greek root word ‘hecto’ Which can be roughly translated as a hundred.

The term hectocorn popped up in startup lingo just a year ago, when private startups like Canva, Brex and Wise began pouring liquidity into valuations as at least one more zero, while SpaceX, ByteDance And middle-aged decacorns like Sheen skyrocketed in hectocorn status.

Which was the first hectocorne?

TikTok’s parent company ByteDance surpassed the Hectocorn benchmark in May 2020 based on a private equity transaction that valued the company at $100 billion.

That sentiment was followed by a private equity round with Sequoia and KKR investing $2 billion in the company at a $180 billion valuation.

How many hectocorns are there?

SpaceX, ByteDance and Shein are currently the only three privately held startups with a $100+ billion valuation.

Complete List of Hectocorns

Here’s a quick breakdown of the world’s three hectocorns, ByteDance SpaceX and Shein, with an emphasis on how they’ve grown to their current size, market position and plans to go public.

1) ByteDance

Description: ByteDance has definitely ventured into multi-hectocorn territory with its short-form video platform TikTok, which has seen rocket growth – fastest among social media companies – attracting young people across the globe and 2021 bringing in $58 billion in revenue.

Bytedance also has several social media platforms such as Toutiao, Douyin, and BuzzVideo, but the crown jewel that has fueled the company’s huge valuation has been their hugely popular short video platform that Meta and Youtube have been trying unsuccessfully to copy or keep up with. .

Year of Establishment: 2012

Place: Haidian Qu, Beijing, China

Grant: $9.4 billion in 12 rounds

Evaluation: $450 billion (October 2021)

DescriptionSpaceX is dazzling the world by opening new horizons in the world of space exploration. Under the super-charismatic Elon’s leadership, SpaceX has achieved several firsts, such as launching and recovering vehicles vertically and being the first private space carrier to dock with the International Space Station.

Much of SpaceX’s revenue has come from launching satellites for the US military, NASA and private corporations, including moonshot plans to colonize Mars and beam satellite internet around the world.

Year of Establishment: 2002

Place: Hawthorne, California, US

Grant: $7.7 billion in 56 rounds

Evaluation: $100.3 billion (October 2021)

3) Sheen

Description:Sheen was funded by Chris Xu in 2008 and initially started as a dropshipping company rather than an online retailer.

The company sells a variety of affordable fashion items for men, women and children through its website and mobile app. The corporation operates in over 220 countries and caters to a young, value-conscious clientele. Sheen is now considered one of China’s top e-commerce enterprises after expanding rapidly in recent years.

Year of Establishment: 2008

Place: Nanjing, China

Grant: $2 billion in 6 rounds

Evaluation: $100 billion (April 2022)

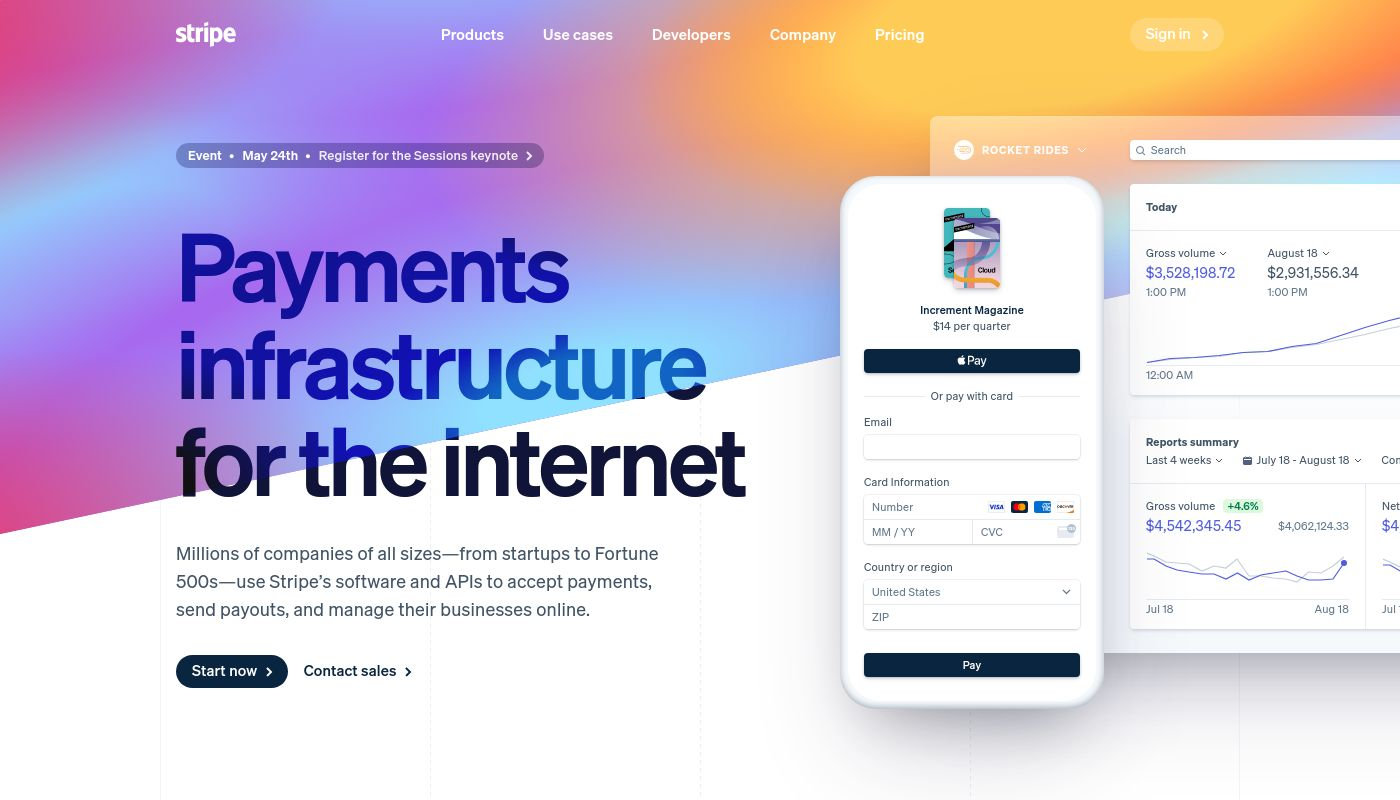

Is Stripe a Hectocorn?

It’s only a matter of time before Stripe has nearly eclipsed PayPal as the leader of the payments market – in fact, it does. Unlike competitors such as PayPal, WePay, and Square, Stripe has built a world-class payment platform built with developers and highly technical users in mind.

That is, you can integrate Stripe into your apps, platforms, etc. and make the payment experience native to your users. And the developers have given it so much attention that it’s the default for the community.

In March 2021, Stripe raised a $600 million Series H that valued it at $95 billion and there is speculation that they may go public in 2023, delaying their IPO and raising another round of funding Which pushes the company into Hectocorn. territory.

Given the gains Stripe has made since their last raise, it’s a given that they’ve crossed a $100 billion valuation and it’ll be long before they raise VC again or go public at that market rate. Just a matter of time.

How do you make a hectocorn?

Startups often get three things right to break into the $100 billion bracket:

- Product-Market Fit.

- Growing revenue (at least $1 billion annually).

- Aggressive venture capital to fuel that growth.

All-in-one newsletter for startup founders

Every week, I’ll send you top 10 startup news and resources and analysis of a failed and a hot company. Join +30,000 other startup founders!

Decacorn needs a solid business model proven to grow revenue, attract VC capital, and expand into that growth category. A quick look at hectocorns past and present such as SpaceX, Coinbase and ByteDance confirms that they have a solid grasp on the revenue channel that is only expected to grow.

Stripe processes at least a trillion dollars worth of payments annually, funneling it to card issuers and interchange networks with a 2.9% profit margin; Coinbase To Bring In Over $8 Billion In Revenue In 2021 On The Back Of The Ongoing Crypto Boom; ByteDance has ridden the wave of short-form video to record revenue figures from its advertising business.

In other words, Hectocorns get there simply by capturing their target market with a product in demand; Experimenting in your dorm room doesn’t make you worth $100 billion.

Growing revenue of at least $1 billion annually

Startups can be valued anywhere between 10 to 1,000 multiples of their revenue. Even in a growing market with skyrocketing valuations, a hectocorn would need at least $1 billion in annual revenue to be valued at $100 billion, assuming a generous 100x revenue multiple.

Of course, lately we’ve seen start-ups rise at unicorn valuations with outrageous revenue multiples (case in point: Airbyte raises $150 million Series B with a unicorn valuation and annual revenue of just under $1 million), but since hectocorns often move quickly to public markets, they need good revenue figures to maintain their valuation after an IPO.

Profitability Still Not a Must

Profit has almost become an old school term in a way that is reminiscent of the dot-com bubble.

Funded startup founders have a belief that if you’re not raising money quickly enough, you’re not growing fast enough. Hence the emphasis on moving fast, breaking things, and spending your way to huge revenues without any profits.

But as the startup nears an IPO or a liquidity event like we mentioned earlier, profits start to trickle back into the bigger picture.

Roles are downsized, non-performing projects and assets are quickly closed to bring in less expenses than revenue. Amazingly, Stripe, SpaceX and ByteDance have not posted consistent profits to date and have been able to work with venture capital so far.

Even after spending years as public companies, Uber, Lyft, Pinterest and Snap still haven’t turned a profit, but that hasn’t hindered their growth or prevented them from raising secondary capital following their listing. It appears that profitability may be delayed even at the hectocorn scale in the short term.

almost exclusively VC-funded

Bootstrapping a startup is nothing new. But having VCs stacked up takes a lot of the pressure off and makes it easier to drive growth by spending fast, so startups favor venture capital. and sometimes you get VCs like softbank Masayoshi the son who threatens to fund your competitors If you refuse to take his money.

As a result, hectocorns are exclusively venture-funded and while it is possible to bootstrap startups into the unicorn, decacorn, and hectocorn realm, as Mailchimp has proven, having venture capital allows them to experiment, scale headcount, and much faster. Lots of room is made to grow.

What to expect for Hectocorn in 2023?

It appears that the year 2023 is the year that the world’s beloved hectocorns finally hit the public markets. sources claim Bandage And bytedance While it is intended to go public in 2023, it is still unclear how long SpaceX will spend as a private company.

But one thing is certain: As this crop of visionaries grows, we have the likes of Klarna, Addin, Canva, Epic Games, Instacart, Revolt, and an army of startups pushing boundaries and creating products people love. Looking to reach new heights in manufacturing.