Rakuten Bank shares soared 40 percent in the company’s debut on Friday, marking Tokyo’s biggest initial public offering since the listing of SoftBank’s mobile unit in 2018.

Internet Bank, Japan’s largest by number of customers and spun out from the country’s biggest e-commerce company Rakuten, raised $625 million in an IPO after downgrading its valuation prior to listing.

Bankers running the IPO at Daiwa Securities faced a range of challenges from investors who questioned valuations and ultimately forced Rakuten to scale down its ambitions for a share sale, people with direct knowledge of the situation said. .

Rakuten Bank was founded in 2000 and has established itself as an online banking pioneer in Japan. While the banking business has been profitable for the past five years, investors have expressed concern that Rakuten Group’s business will suffer as a result of mounting losses at its mobile unit.

The stock was sold at ¥1,400 ($10) per share in the IPO – well below the ¥1,960 at the top of the floating range. On Friday, shares of newly listed Rakuten Bank briefly overcame that target to hit a high of 1,965 yen, while Rakuten Group fell more than 2 percent.

“I’m not surprised that shares of Rakuten Bank have done this,” said Travis Lundy, an independent analyst published on SmartKarma. “It’s IPO at a discount to major Japanese banks, it has a high expected growth rate and high return on equity, so it was always going to be an asset in demand.”

The Rakuten Bank IPO coincides with a revival of foreign investor interest in Japan, where a large number of shares are undervalued and activists have recently been successful with demands for stock buybacks and other shareholder-friendly action.

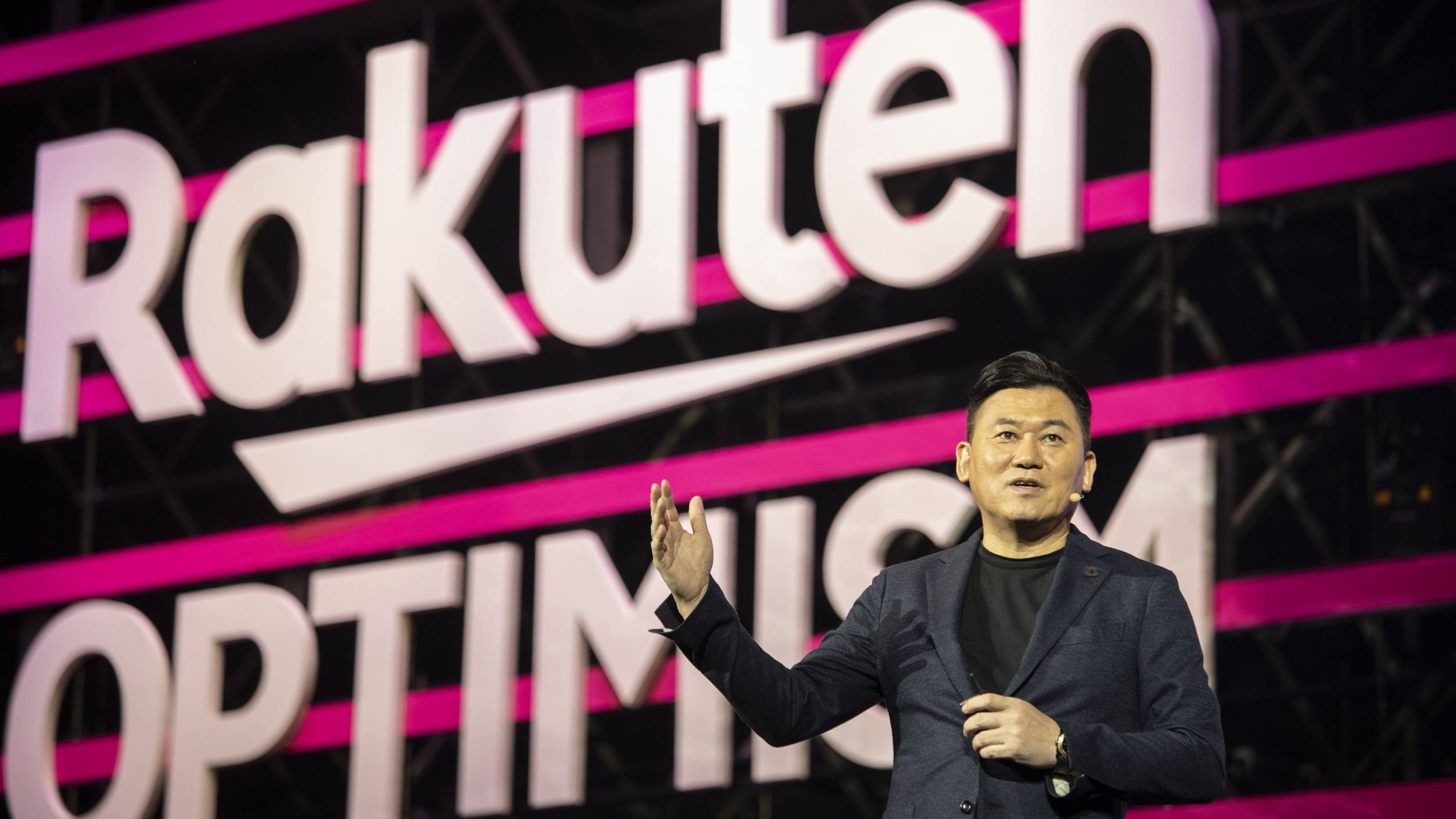

Rakuten Group, led by flamboyant Japanese tech entrepreneur Hiroshi Mikitani, launched a mobile network in 2020 during the early months of the pandemic and has been raking in the money ever since. In 2017, Rakuten signed a four-season €55mn-a-year shirt sponsorship deal with Barcelona FC, which drew criticism from investors.

Rakuten’s mobile network business was immediately faced with a government-led price-cutting regime and only managed to capture a market share of about 3 percent. In February, Rakuten Group announced a record annual loss of ¥372.9bn, posting losses for the fourth year in a row. The banking unit posted an annual profit of ¥20bn last year.

Several fund managers who considered investing in the Rakuten Bank IPO said they ultimately decided against doing so because of what they perceived as the “chaotic” nature of the relationship between the Rakuten parent and the bank.

A fund manager said the relationship was fraught with potential conflicts of interest relating to transfer pricing of services between parent and child companies.

recommended

A broker at a Japanese securities firm not involved in the IPO said it was not surprising that the promise of a Rakuten Bank listing had not boosted Rakuten Group’s share price.

“There are many good reasons to buy Rakuten, as it is a unique Japanese company with exposure in the growing ecommerce market. The problem for large fund managers is that Mikitani has built a reputation for unpredictability, and that is holding down stocks,” the broker said, referring to a series of business decisions, including the sponsorship of Barcelona, that unsettled investors. Have given.

As a prominent chief executive, Mikitani has attracted attention in Japan for his life outside of work.

Last August, a five-second video was posted on social media that appeared to show Mikitani pouring Dom Perignon champagne into a party-goer’s mouth surrounded by young women at a nightclub. The clip went viral, sparking a scandal.